Diverse Menu Options

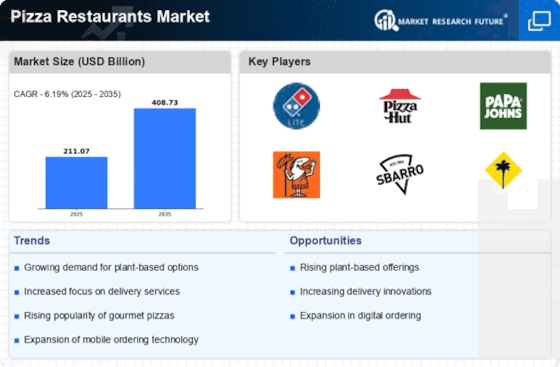

The Pizza Restaurants Market is experiencing a notable shift towards diverse menu offerings. Consumers increasingly seek variety, including gluten-free, vegan, and organic options. This trend is driven by changing dietary preferences and health consciousness. According to recent data, approximately 30% of consumers express a preference for restaurants that offer healthier alternatives. Consequently, pizza restaurants are expanding their menus to cater to these demands, which may enhance customer satisfaction and loyalty. The introduction of unique toppings and innovative flavor combinations also plays a crucial role in attracting a broader customer base. As a result, the ability to provide diverse menu options appears to be a significant driver in the Pizza Restaurants Market.

Expansion of Fast Casual Dining

The Pizza Restaurants Market is experiencing a notable expansion of fast casual dining concepts. This segment combines the convenience of quick service with the quality of sit-down dining, appealing to a broad demographic. Recent trends indicate that fast casual pizza restaurants are growing at a rate of approximately 10% annually. This growth is likely attributed to changing consumer preferences for a more relaxed dining experience without compromising on quality. Additionally, the emphasis on customization allows customers to tailor their pizzas to their liking, further enhancing the appeal. Consequently, the expansion of fast casual dining is a key driver in the Pizza Restaurants Market.

Innovative Marketing Strategies

The Pizza Restaurants Market is witnessing a surge in innovative marketing strategies aimed at capturing consumer attention. With the proliferation of social media, pizza restaurants are leveraging platforms to engage with customers in creative ways. For instance, interactive campaigns and user-generated content have become prevalent, allowing brands to foster a sense of community. Recent statistics suggest that restaurants utilizing social media marketing experience a 20% increase in customer engagement. Furthermore, collaborations with influencers and local events enhance brand visibility and attract new customers. This focus on innovative marketing strategies is likely to play a pivotal role in shaping the competitive landscape of the Pizza Restaurants Market.

Convenience and Delivery Services

In the Pizza Restaurants Market, the demand for convenience is paramount. The rise of food delivery services has transformed consumer behavior, with many opting for the ease of ordering pizza from home. Data indicates that delivery sales account for over 50% of total pizza sales in many regions. This shift is likely influenced by busy lifestyles and the increasing reliance on technology for food ordering. Pizza restaurants are responding by enhancing their delivery capabilities, including partnerships with third-party delivery platforms. Additionally, the implementation of user-friendly mobile apps and websites facilitates seamless ordering experiences. Thus, the emphasis on convenience and delivery services is a critical driver in the Pizza Restaurants Market.

Rising Demand for Quality Ingredients

The Pizza Restaurants Market is increasingly characterized by a rising demand for high-quality ingredients. Consumers are becoming more discerning, often prioritizing fresh, locally sourced, and organic components in their food choices. This trend is reflected in the growing popularity of artisanal pizzas, which emphasize quality over quantity. Data shows that nearly 40% of consumers are willing to pay a premium for pizzas made with superior ingredients. As a result, pizza restaurants are adapting their sourcing practices to meet these expectations, which may enhance their reputation and customer loyalty. The emphasis on quality ingredients is thus a significant driver in the Pizza Restaurants Market.

.png)