Market Growth Projections

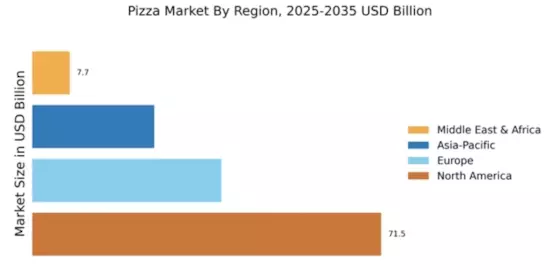

The Global Pizza Market Industry is poised for substantial growth, with projections indicating a market value of 210 USD Billion by 2035. This anticipated growth is underpinned by various factors, including rising consumer demand for convenience foods and the expansion of delivery services. The compound annual growth rate of 2.8% from 2025 to 2035 reflects the industry's resilience and adaptability in meeting consumer preferences. As pizza continues to evolve, incorporating innovative flavors and healthier options, the market is likely to attract a diverse customer base. These growth projections underscore the industry's potential to thrive in an increasingly competitive food landscape.

Expansion of Delivery Services

The Global Pizza Market Industry benefits significantly from the expansion of delivery services, which have become integral to consumer purchasing behavior. The proliferation of online ordering platforms and mobile applications facilitates easy access to pizza, catering to the increasing demand for home delivery. This trend is particularly relevant in urban areas, where convenience is paramount. As a result, pizza chains are investing in technology to enhance their delivery capabilities, ensuring timely service and customer satisfaction. The industry's adaptation to this delivery-centric model is expected to contribute to a compound annual growth rate of 2.8% from 2025 to 2035, reflecting the importance of convenience in driving market growth.

Globalization of Pizza Culture

The Global Pizza Market Industry is significantly influenced by the globalization of pizza culture, which facilitates the exchange of culinary traditions across borders. As pizza becomes a staple in various countries, local adaptations emerge, enriching the overall market landscape. This cultural exchange not only diversifies product offerings but also enhances consumer engagement. For instance, the incorporation of regional ingredients and flavors into pizza recipes can attract a broader audience. The globalization trend suggests a vibrant and evolving market, with the potential for sustained growth as new consumer bases are cultivated. This dynamic environment may contribute to the industry's projected market value of 155.0 USD Billion in 2024.

Innovative Toppings and Flavors

Innovation within the Global Pizza Market Industry plays a crucial role in attracting diverse consumer segments. The introduction of unique toppings and flavors caters to evolving tastes and dietary preferences. For instance, the rise of plant-based and gourmet pizzas has expanded the market's reach, appealing to health-conscious consumers and food enthusiasts alike. This trend not only enhances customer satisfaction but also drives sales growth. As the industry adapts to these culinary trends, it is likely to witness sustained interest, contributing to the projected market value of 210 USD Billion by 2035. The continuous exploration of new flavor profiles indicates a dynamic and responsive market.

Health-Conscious Consumer Trends

The Global Pizza Market Industry is witnessing a shift towards health-conscious consumer trends, prompting pizza manufacturers to innovate healthier options. This includes the introduction of whole grain crusts, reduced-fat cheeses, and organic toppings, catering to consumers who prioritize nutrition without sacrificing taste. As awareness of health issues increases, the demand for pizzas that align with dietary preferences is likely to grow. This trend not only broadens the market's appeal but also positions it favorably in a competitive landscape. The industry's responsiveness to these health trends may play a pivotal role in sustaining its growth, potentially leading to a market value of 210 USD Billion by 2035.

Rising Demand for Convenience Foods

The Global Pizza Market Industry experiences a notable surge in demand for convenience foods, driven by the fast-paced lifestyle of consumers. As individuals increasingly seek quick meal solutions, pizza emerges as a preferred option due to its ready-to-eat nature. In 2024, the market is valued at approximately 155.0 USD Billion, reflecting a growing inclination towards fast food. This trend is particularly pronounced among younger demographics, who prioritize convenience and flavor. The industry's ability to adapt to consumer preferences, such as offering delivery and takeout options, further enhances its appeal, suggesting a robust growth trajectory in the coming years.