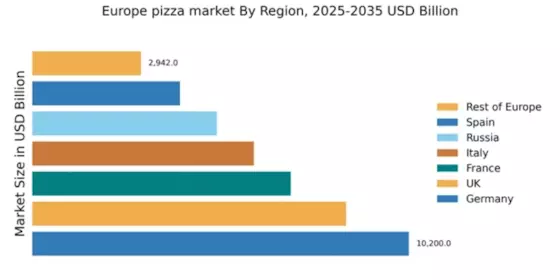

Germany : Leading the European Pizza Scene

Key markets include major cities like Berlin, Munich, and Hamburg, where the competitive landscape is dominated by international players such as Domino's and Pizza Hut. Local chains are also gaining traction by offering unique regional flavors. The business environment is characterized by a strong emphasis on quality and sustainability, with many establishments focusing on organic ingredients. The pizza sector is increasingly integrating technology, with online ordering and delivery apps becoming essential for market players.

UK : Diverse Tastes Drive Demand

Key markets include London, Manchester, and Birmingham, where competition is fierce among major players like Domino's and Papa John's. Local pizzerias are thriving by offering artisanal and gourmet options. The business environment is dynamic, with a strong emphasis on customer experience and digital engagement. The pizza sector is increasingly influenced by health trends, with many consumers opting for gluten-free and vegan alternatives.

France : A Taste for Quality and Variety

Key markets include Paris, Lyon, and Marseille, where competition is marked by both international chains and local artisans. Major players like Domino's and Pizza Hut coexist with numerous independent pizzerias that emphasize traditional recipes. The business environment is characterized by a focus on culinary excellence and innovation, with many establishments experimenting with unique toppings and flavors. The pizza sector is also benefiting from the growing trend of food delivery services.

Russia : Emerging Trends and Opportunities

Key markets include Moscow and St. Petersburg, where competition is intensifying among major players like Domino's and local chains. The business environment is evolving, with a growing emphasis on digital ordering and delivery platforms. Local preferences are influencing menu offerings, with unique toppings and flavors gaining popularity. The pizza sector is also seeing increased interest in health-conscious options, reflecting broader consumer trends.

Italy : Tradition Meets Modern Trends

Key markets include Naples, Rome, and Milan, where the competitive landscape features a mix of traditional pizzerias and modern chains. Major players like Domino's are present, but local establishments dominate with authentic offerings. The business environment is characterized by a focus on culinary heritage and quality, with many pizzerias emphasizing artisanal methods. The pizza sector is also adapting to trends such as online ordering and delivery services.

Spain : Flavorful Innovations and Trends

Key markets include Madrid and Barcelona, where competition is vibrant among major players like Domino's and local pizzerias. The business environment is dynamic, with a strong emphasis on customer engagement and innovative offerings. Local preferences are influencing menu items, with a growing interest in Mediterranean flavors and health-conscious options. The pizza sector is also benefiting from the increasing popularity of food delivery apps.

Rest of Europe : Diverse Opportunities Await

Key markets include cities in Poland, Hungary, and the Czech Republic, where competition is growing among local and international players. Major brands like Domino's are expanding their presence, while local chains are gaining traction by offering unique regional flavors. The business environment is characterized by a focus on quality and affordability, with many establishments adapting to local tastes. The pizza sector is also seeing increased interest in delivery services and online ordering.