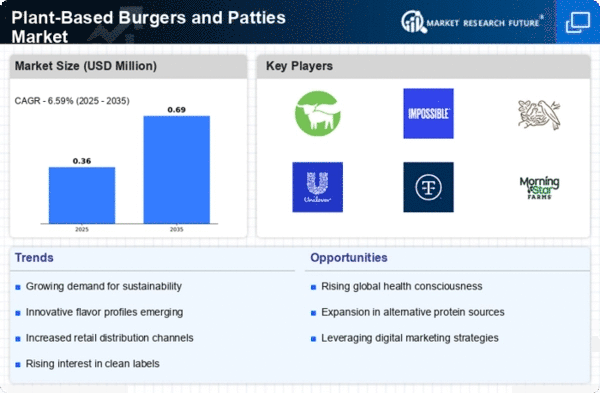

The Plant-Based Burgers and Patties Market is currently characterized by a dynamic competitive landscape, driven by increasing consumer demand for sustainable and health-conscious food options. Key players are actively innovating and expanding their product lines to capture market share. Companies such as Beyond Meat (US) and Impossible Foods (US) are at the forefront, focusing on product innovation and strategic partnerships to enhance their market presence. Beyond Meat (US) has been particularly aggressive in expanding its distribution channels, while Impossible Foods (US) emphasizes its commitment to sustainability and environmental impact, which resonates with a growing segment of eco-conscious consumers. This collective focus on innovation and sustainability shapes a competitive environment that is increasingly centered around product differentiation rather than price alone.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market appears moderately fragmented, with several players vying for dominance. However, the influence of major companies like Nestle (CH) and Unilever (GB) cannot be understated, as their extensive resources and global reach allow them to set trends and standards within the industry. These companies are leveraging their established supply chains to introduce plant-based products that appeal to a broader audience, thereby intensifying competition.

In November 2025, Beyond Meat (US) announced a partnership with a leading fast-food chain to introduce a new line of plant-based burgers aimed at mainstream consumers. This strategic move is likely to enhance brand visibility and accessibility, potentially driving significant sales growth. The collaboration underscores Beyond Meat's strategy to penetrate the fast-food sector, which remains a critical battleground for plant-based products.

In October 2025, Impossible Foods (US) launched a new product line featuring plant-based patties designed specifically for grilling. This initiative not only caters to the growing demand for outdoor cooking options but also positions the company as a leader in product innovation. The introduction of grilling-specific products may attract a new customer base, further solidifying Impossible Foods' market position.

In September 2025, Nestle (CH) expanded its plant-based portfolio by acquiring a smaller company specializing in vegan cheese alternatives. This acquisition is indicative of Nestle's strategy to diversify its offerings and integrate plant-based options across various food categories. By enhancing its product range, Nestle aims to capture a larger share of the health-conscious consumer market, which is increasingly seeking diverse plant-based options.

As of December 2025, current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies in product development and marketing strategies. Strategic alliances are becoming increasingly prevalent, allowing companies to pool resources and expertise to enhance their competitive edge. Looking ahead, it is anticipated that competitive differentiation will evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize sustainable practices and technological advancements are likely to thrive in the evolving market landscape.

Leave a Comment