Increasing Demand for Automation

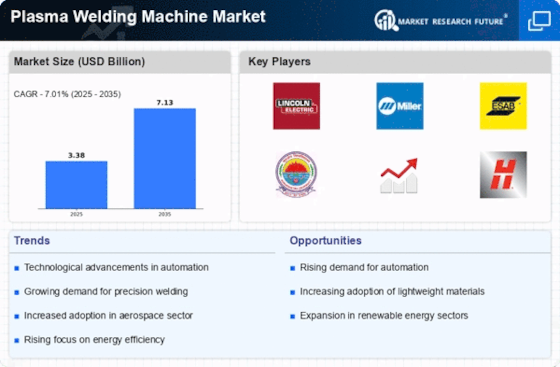

The Plasma Welding Machine Market is experiencing a notable surge in demand for automation across various sectors. Industries such as automotive, aerospace, and manufacturing are increasingly adopting automated welding solutions to enhance productivity and precision. This shift towards automation is driven by the need for higher efficiency and reduced labor costs. According to recent data, the automation segment within the welding industry is projected to grow at a compound annual growth rate of approximately 7% over the next five years. As companies strive to optimize their operations, the integration of plasma welding machines into automated systems appears to be a strategic move, thereby propelling the Plasma Welding Machine Market forward.

Growing Focus on Energy Efficiency

The Plasma Welding Machine Market is witnessing a growing focus on energy efficiency, driven by both regulatory pressures and corporate sustainability goals. As industries strive to reduce their carbon footprint, the demand for energy-efficient welding solutions is on the rise. Plasma welding machines, known for their lower energy consumption compared to traditional welding methods, are becoming increasingly popular. Recent studies indicate that energy-efficient welding technologies could reduce operational costs by up to 30%, making them an attractive option for manufacturers. This emphasis on sustainability and cost-effectiveness is likely to propel the Plasma Welding Machine Market as companies seek to align with environmental standards.

Expansion of Manufacturing Capabilities

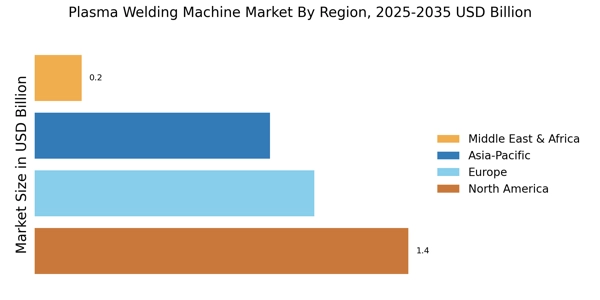

The Plasma Welding Machine Market is benefiting from the expansion of manufacturing capabilities across various sectors. As industries evolve, there is a growing need for advanced welding solutions that can accommodate diverse materials and complex designs. The expansion of manufacturing facilities, particularly in emerging economies, is expected to drive demand for plasma welding machines. Recent market analyses suggest that the manufacturing sector could see a growth rate of around 4% annually, with plasma welding technology playing a crucial role in enhancing production efficiency. This trend indicates a promising outlook for the Plasma Welding Machine Market, as manufacturers seek to leverage advanced welding technologies to meet increasing production demands.

Technological Innovations in Welding Equipment

Technological innovations are playing a pivotal role in shaping the Plasma Welding Machine Market. The introduction of advanced features such as real-time monitoring, enhanced control systems, and improved energy efficiency is attracting manufacturers to invest in modern plasma welding machines. These innovations not only enhance the quality of welds but also reduce operational costs, making them more appealing to businesses. Recent advancements suggest that the market for plasma welding machines could expand by approximately 6% annually, as companies increasingly prioritize cutting-edge technology to maintain competitive advantages. This trend underscores the importance of continuous innovation within the Plasma Welding Machine Market.

Rising Adoption in Aerospace and Automotive Sectors

The Plasma Welding Machine Market is significantly influenced by the rising adoption of plasma welding technology in the aerospace and automotive sectors. These industries require high-quality welds that can withstand extreme conditions, making plasma welding an ideal choice. The aerospace sector, in particular, is projected to witness a growth rate of around 5% annually, driven by the increasing demand for lightweight materials and complex geometries. Similarly, the automotive industry is focusing on advanced welding techniques to improve vehicle performance and safety. This trend indicates a robust future for the Plasma Welding Machine Market, as manufacturers seek to meet stringent quality standards and enhance production capabilities.