Focus on Energy Efficiency and Cost Reduction

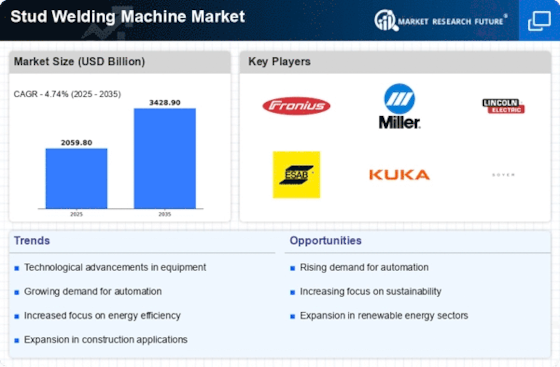

The Stud Welding Machine Market is increasingly focusing on energy efficiency and cost reduction as key drivers of growth. Manufacturers are under pressure to produce equipment that not only meets performance standards but also minimizes energy consumption. This shift is largely due to rising energy costs and a growing emphasis on sustainability. Energy-efficient stud welding machines can lead to significant savings in operational costs, making them attractive to businesses looking to enhance their bottom line. Furthermore, as regulations around energy use become more stringent, the demand for machines that comply with these standards is expected to rise, creating opportunities for innovation and market expansion.

Rising Investment in Manufacturing Automation

The Stud Welding Machine Market is benefiting from the rising investment in manufacturing automation. As industries strive to enhance productivity and reduce labor costs, there is a growing trend towards automating welding processes. Automated stud welding machines offer consistent quality and speed, which are essential for high-volume production environments. This trend is particularly evident in sectors such as aerospace and heavy machinery, where precision and reliability are paramount. The global market for industrial automation is projected to reach substantial figures in the coming years, indicating a robust growth trajectory for stud welding machines that integrate automation technologies.

Technological Innovations in Welding Equipment

The Stud Welding Machine Market is experiencing a surge in technological innovations that enhance the efficiency and precision of welding processes. Advanced features such as automated controls, real-time monitoring, and integration with Industry 4.0 technologies are becoming increasingly prevalent. These innovations not only improve the quality of welds but also reduce operational costs. For instance, the introduction of inverter technology has led to more compact and energy-efficient machines, appealing to manufacturers seeking to optimize their production lines. As a result, the demand for modern stud welding machines is likely to rise, driven by the need for improved performance and reduced downtime in various sectors, including construction and automotive.

Increasing Focus on Quality and Safety Standards

The Stud Welding Machine Market is witnessing an increasing focus on quality and safety standards across various sectors. As industries become more aware of the implications of poor welding practices, there is a heightened demand for machines that comply with stringent quality assurance protocols. This trend is particularly relevant in sectors such as construction and manufacturing, where safety is critical. Regulatory bodies are implementing more rigorous standards, which in turn drives the need for advanced stud welding machines that can deliver high-quality results consistently. Companies that prioritize compliance with these standards are likely to gain a competitive edge in the market.

Growing Demand from Construction and Automotive Sectors

The Stud Welding Machine Market is significantly influenced by the growing demand from the construction and automotive sectors. These industries require robust and reliable welding solutions to ensure structural integrity and safety. In recent years, the construction sector has seen a notable increase in infrastructure projects, which in turn drives the need for efficient welding equipment. According to industry reports, the automotive sector is projected to grow at a compound annual growth rate of approximately 4% over the next few years, further fueling the demand for stud welding machines. This trend indicates a strong market potential for manufacturers who can provide high-quality, durable welding solutions tailored to these industries.

.png)