Rising Demand in Automotive Sector

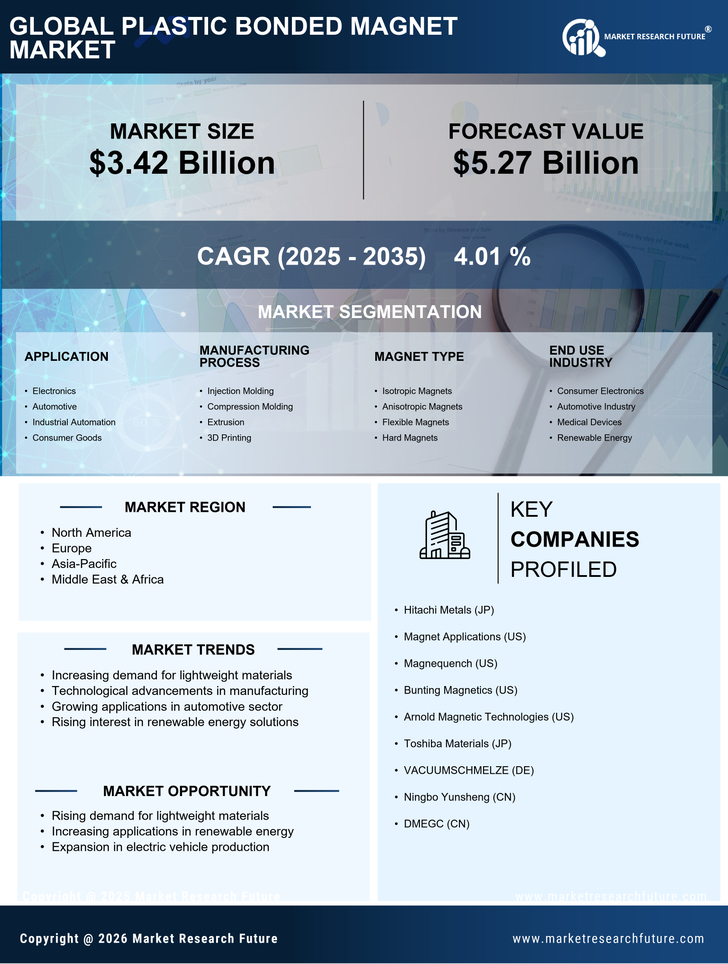

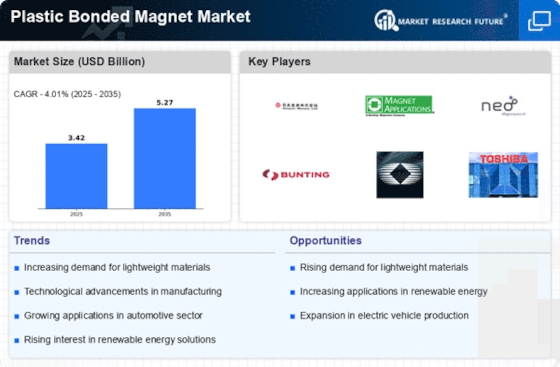

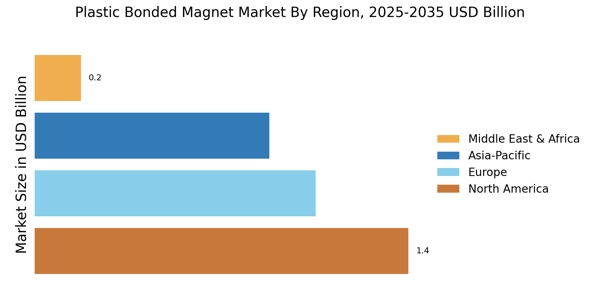

The automotive sector is experiencing a notable increase in the adoption of electric vehicles (EVs) and hybrid vehicles, which is likely to drive the Plastic Bonded Magnet Market. These vehicles require efficient and lightweight components, and plastic bonded magnets are increasingly favored for their superior performance and reduced weight. As per recent data, the automotive industry is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next few years. This growth is expected to enhance the demand for plastic bonded magnets, which are utilized in various applications such as motors and sensors, thereby propelling the Plastic Bonded Magnet Market forward.

Emerging Markets and Economic Growth

Emerging markets are experiencing rapid economic growth, leading to increased industrialization and urbanization. This growth is likely to drive the demand for plastic bonded magnets across various sectors, including automotive, electronics, and renewable energy. As industries in these regions expand, the need for efficient and cost-effective magnetic solutions is expected to rise. The Plastic Bonded Magnet Market stands to benefit from this trend, as manufacturers look to capitalize on the growing demand for innovative products. The expansion of infrastructure and technological advancements in these markets may further enhance the relevance of plastic bonded magnets, indicating a positive outlook for the industry.

Advancements in Manufacturing Techniques

Innovations in manufacturing processes are playing a crucial role in shaping the Plastic Bonded Magnet Market. Techniques such as injection molding and 3D printing are becoming more prevalent, allowing for the production of complex shapes and designs that were previously unattainable. These advancements not only improve the efficiency of production but also reduce waste, aligning with sustainability goals. The market for plastic bonded magnets is anticipated to expand as manufacturers adopt these advanced techniques, potentially increasing production capacity and lowering costs. This trend indicates a promising future for the Plastic Bonded Magnet Market, as it adapts to meet evolving consumer demands.

Growing Applications in Consumer Electronics

The consumer electronics sector is witnessing a surge in the use of plastic bonded magnets, which are integral to various devices such as smartphones, tablets, and wearables. The increasing demand for compact and lightweight electronic devices is likely to bolster the Plastic Bonded Magnet Market. Recent statistics suggest that the consumer electronics market is expected to grow at a CAGR of around 5% in the coming years. This growth is anticipated to drive the need for efficient magnetic solutions, thereby enhancing the relevance of plastic bonded magnets in this sector. As manufacturers strive to create more innovative products, the Plastic Bonded Magnet Market is poised for significant expansion.

Increased Focus on Renewable Energy Solutions

The shift towards renewable energy sources is becoming increasingly pronounced, with wind and solar energy applications requiring efficient magnetic materials. Plastic bonded magnets are gaining traction in these applications due to their lightweight and corrosion-resistant properties. The renewable energy sector is projected to grow substantially, with investments in wind and solar energy expected to reach unprecedented levels. This trend is likely to create new opportunities for the Plastic Bonded Magnet Market, as manufacturers seek to provide innovative solutions that meet the demands of this evolving market. The integration of plastic bonded magnets in renewable energy technologies could significantly enhance their performance and efficiency.