Market Share

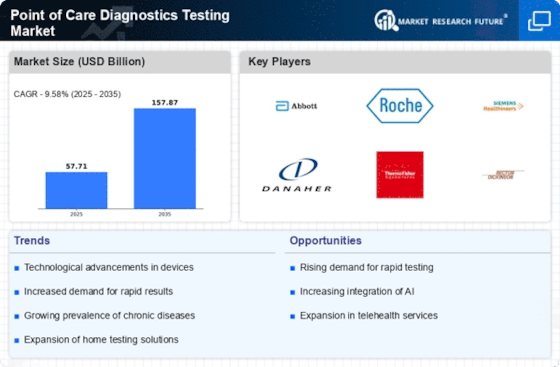

Point of Care Diagnostics Testing Market Share Analysis

In this fast-moving field of point-of-care diagnostics/Testing, firms use various strategies for positioning their market share in an ever-changing environment. Amongst these strategies, one stands out to be vital: technological innovation, where companies invest in robust diagnostics that are capable of faster results at the point of care. Customization and adaptability are also very important aspects of positioning in the marketplace. Customers' needs differ from one setting to another, such as hospitals, clinics, and remote areas where these products are used. Companies can design their products to fit into different healthcare workflows by offering a range of customizable POC diagnostic tools. Positioning strategies based on market share can only be successful if they are cost-effective in the Point of Care Diagnostics/Testing Market. Companies want to make sure that their testing solutions will give accurate results while minimizing overall costs. This makes their affordability a crucial aspect to care providers with budgetary constraints and facilitates the widespread acceptance of point-of-care diagnostics. Strategic partnerships and collaborations play an important role in positioning for market share. To further increase the extent and penetration of markets, firms form alliances with healthcare institutions, clinics, or distribution partners. Collaborations may involve joint research and development efforts, co-marketing agreements, or shared distribution networks. If companies leverage the strengths of strategic partners within them, then they will effectively expand their presence in this area of diagnostics by reaching more customers, including key stakeholders. Another crucial strategy is market segmentation in the Point of Care Diagnostics/Testing Market. Considering diverse diagnostic needs in healthcare organizations, companies have designed specialized diagnostic solutions for various areas, such as cardiology and infectious diseases, among others. Whether it is infectious diseases, cardiovascular health, or oncology, dedicated point-of-care tests enable them to capture a share within these specific healthcare domains. Educational initiatives and training programs are critical elements when it comes to market share positioning. For instance, companies invest in educating medical professionals about how to use point-of-care diagnostic tools effectively. By making training programs and resources available for clinicians, these companies empower them towards effective, seamless integration of such diagnostics into practice, thus building trust and reliance upon technology. When informed about specific point-of-care diagnostic devices through education, healthcare professionals themselves become supporters, leading to an increased adoption rate and gaining market shares.

Leave a Comment