Polyacrylamide Size

Polyacrylamide Market Growth Projections and Opportunities

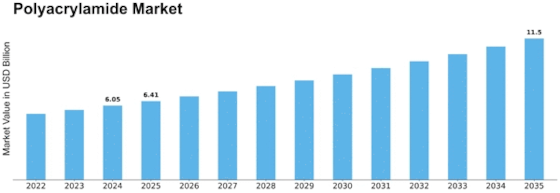

Polyacrylamide Market Size was valued at USD 5.01 billion in 2021 . The Polyacrylamide market industry is projected to grow from USD 5.39 Billion in 2022 to USD 8.59 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.01%

The polyacrylamide market is influenced by a multitude of factors that collectively shape its dynamics. One of the primary drivers is the increasing demand from various industries, including water treatment, petroleum, paper, and agriculture. Polyacrylamide is widely used as a flocculant and thickening agent in water treatment processes, as well as in enhanced oil recovery in the petroleum industry. The versatility of polyacrylamide in different applications contributes significantly to its market growth, with water scarcity concerns driving demand for efficient water treatment solutions.

Environmental regulations play a pivotal role in shaping the polyacrylamide market. As governments and industries worldwide focus on sustainable practices, there is a growing demand for water-soluble polymers like polyacrylamide, which can aid in effective wastewater treatment and reduce environmental impact. Stricter regulations regarding the discharge of pollutants into water bodies drive the adoption of polyacrylamide in various treatment processes, positioning it as a key solution for environmental compliance.

Innovation and technological advancements are critical factors propelling the polyacrylamide market forward. Ongoing research and development efforts aim to enhance the efficiency and environmental compatibility of polyacrylamide-based products. Tailoring formulations to address specific challenges in different industries, such as improving oil recovery rates or optimizing soil conditioning in agriculture, drives continuous innovation in the polyacrylamide sector. Manufacturers strive to stay ahead in the competitive landscape by introducing products that offer improved performance and meet evolving industry needs.

The global economic landscape significantly impacts the polyacrylamide market. Economic growth, particularly in emerging markets, leads to increased industrial activities and urbanization, resulting in higher demand for water treatment and related applications. Conversely, economic downturns may temporarily affect industries like petroleum and manufacturing, impacting the demand for polyacrylamide. The market is closely tied to overall economic health, with fluctuations influencing the buying patterns of end-users.

Raw material availability and pricing are crucial considerations for participants in the polyacrylamide market. Acrylamide, the primary raw material for polyacrylamide production, is derived from petrochemical sources. Fluctuations in oil prices directly influence the production cost of polyacrylamide. Manufacturers closely monitor raw material markets to adapt their strategies and maintain cost-effectiveness in the competitive polyacrylamide market.

Geographical factors also play a role in shaping the polyacrylamide market. The distribution of end-use industries, regulatory frameworks, and environmental concerns vary across regions. For instance, regions facing water scarcity may have a higher demand for polyacrylamide in water treatment applications. Additionally, different regions may have varying regulations regarding the use of polyacrylamide, influencing market dynamics and formulation requirements.

Leave a Comment