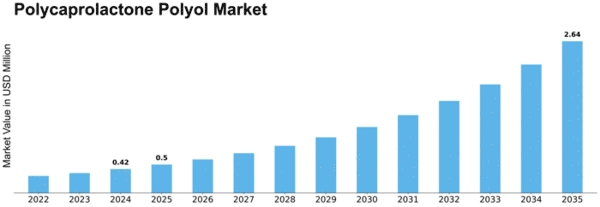

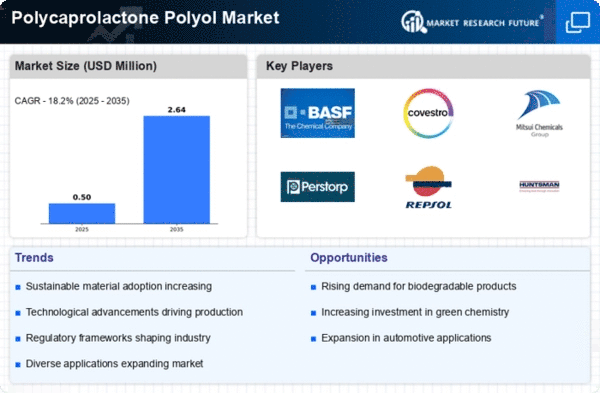

Polycaprolactone Polyol Size

Polycaprolactone Polyol Market Growth Projections and Opportunities

Several market factors influence the polycaprolactone polyol market, which is instrumental in shaping its dynamics. The demand for environmentally friendly and sustainable materials is one of the key drivers of growth in different industries. With increasing emphasis on eco products, polycaprolactone polyol, being biodegradable polyester, falls under this category. Besides, the versatility of Polycaprolactone Polyol contributes a lot to its market development. It has low viscosity, excellent adhesion, and flexibility, among other peculiarities, making it suitable for a wide range of uses. These characteristics benefit industries like adhesives, coatings, and sealants, which stimulate the expansion of the polycaprolactone polyol market. Besides that, its ability to serve with various substrates also enhances its usefulness, thereby making it a favorite choice for manufacturers who want versatile materials. Moreover, The global push towards technological advancements and innovation also fuels the Polycaprolactone Polyol market, hence increasing its scope through continuous research and innovations in PCR resins applications, leading to more consumers, thus pushing market expansion over time, further enhancing innovation has broadened application fields of PCPs, including diverse markets who different scholars have identified as a driver behind increased availability of synthetic polymers due to their low-cost production processes coupled with less expensive PCP raw material prices currently being experienced across the globe some companies are forced to make both high-quality standards. Hence, having competitive pricing strategies since they all focus on capturing huge markets within this industry, inflation rates caused by currency exchange fluctuations as well changes in the world's economies generally shape layout affecting company regulation may also modify direction moreover geographical position combined regional aspects can cause strong variations this volatile business weather. Finally, various factors contribute to the volatility of this marketplace, including sustainability policies, worldwide trade agreements, and political instability, among others, might trigger shifts within value chains and lead to an increase or decrease in supply levels of any offshore chemical upon which pricing policies depend Raw materials resulting these pressures Companies must react quickly changing circumstances earlier to 2025 and remain relevant this market.

Leave a Comment