Market Trends

Key Emerging Trends in the Polycaprolactone Polyol Market

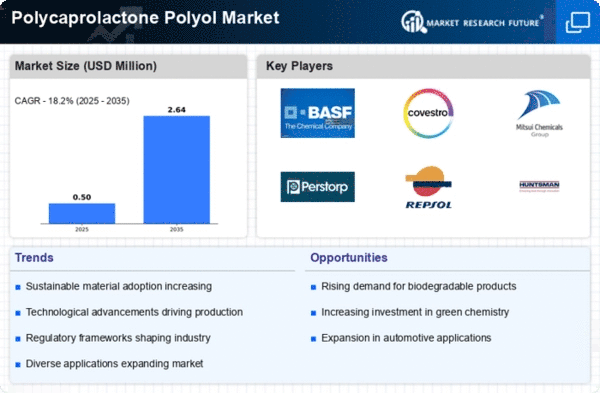

There are some trends in the current market for polycaprolactone polyol. Due to the peculiarities and versatility of this polymer, its demand is rising day by day as it is employed in various fields of application. One trend happening now on the market regards an increased utilization of polycaprolactone polyols for manufacturing polyurethane-based products. Also, companies tend to focus on eco-friendly materials that have become very popular lately, with bio-based polycaprolactones being emphasized. Manufacturers have been spending more money on raw materials that come from renewable sources of energy, and global campaigns for sustainability have prompted this change. It should be noted that this shift towards environmental concerns and consumer preferences for eco-friendly goods. Moreover, another significant trend in the polycaprolactone polyol market is seen in the healthcare and medical sectors. The biocompatibility and biodegradability properties found in these polymers make them suitable for use in healthcare devices such as medical implants, drug delivery systems, and tissue engineering applications, among others. Similarly, automotive industry players have raised the adoption of polycaprolactone polyol. Its lightness makes it useful both as a vehicle component and brings about improved mechanical properties of different automotive materials used, including but not limited to vehicles' parts, among others. Otherwise, there will be slow growth in PCL use since the automotive sector shifts toward electric cars and lighter-weight materials, thus saving fuel. With respect to geography, Asia-Pacific remains one of the key players in the Polycaprolactone Polyol market. Demand for polycaprolactone polyol has increased due to the emergence of industries coupled with an upswing manufacturing sector. China has played an integral part here through its strong base in manufacturing coupled with increased investment in research and development. Nevertheless, like any other market, the Polycaprolactone Polyol market has some challenges. Its manufacturers are faced with fluctuations in feedstock prices and intricate processes of production. Cost-effective ways of production are being considered while strategic partnerships have been established to ensure continuity in product supply chains.

Leave a Comment