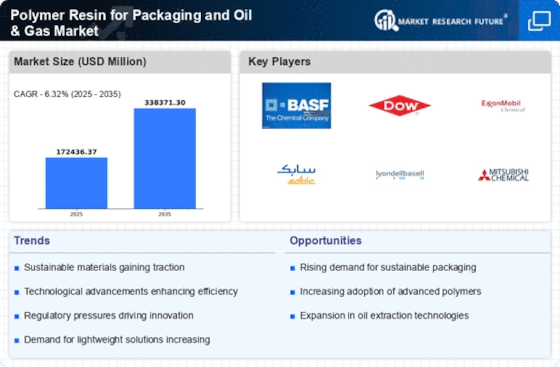

Many regional and local vendors characterize polymer resin for packaging and oil & gas market. The market is highly competitive, with all the players competing to gain maximum market share. The increasing polymer resin demand in the packaging and oil & gas sectors is boosting the sales of polymer resin. The vendors compete based on cost, product quality, and the availability of the products according to the geographies. The vendors must provide cost-effective and high-quality polymer resin to compete in the market.

The market players' growth depends on the market and economic conditions, government regulations, and industrial development. Thus, the players should focus on expanding their production capacity to meet the demand and enhance their product portfolio. Borealis AG, BASF SE, Evonik Industries AG, LyondellBasell Industries N.V, Shell Plc, Solvay, Roto Polymers, Dow Chemical Company, Nan Ya Plastics Corp, Saudi Arabia Basic Industries Corporation, Celanese Corporation, INEOS Group, and Exxon Mobil Corporation are the major companies in the market at the present that are competing in terms of quality, price, and availability.

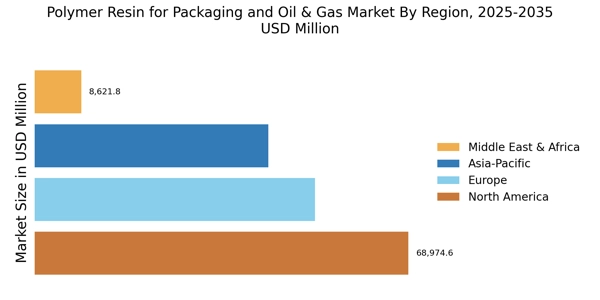

These players are primarily focusing on the development of polymer resin. Although the international players dominate the market, regional and local players with small market shares also have a moderate presence. The international players with a global presence, with established manufacturing units or sales offices, have strengthened their presence across major regions such as North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Borealis AG: Borealis AG is a leader in polyolefin recycling in Europe and one of the world's top suppliers of cutting-edge, environmentally friendly polyolefin solutions. The company dominates the base chemical and fertilizer markets in Europe. The company has made a name for itself as a trustworthy business partner and a recognized global brand that continually adds value for its partners, clients, and customers.

The company is a joint venture between OMV, a global oil and gas business with headquarters in Austria, which holds 75% of shares, and Abu Dhabi National Oil Corporation (ADNOC), with headquarters in the United Arab Emirates (UAE), which has the remaining 25%. Through Borealis and two significant joint ventures, Borouge (with ADNOC, based in the UAE) and BaystarTM (with TotalEnergies, based in the US), provide services and goods to clients all over the world. The company has customer service centers in Austria, Belgium, Finland, France, Turkey, United States.

Production Plants are in Austria, Belgium, Brazil, Finland, France, Germany, Italy, South Korea, Sweden, The Netherlands, United States, and innovation centers are in Austria, Finland, and Sweden. The company has an operational presence in 120 counties across Europe, North America, Asia-Pacific, Latin America, Middle East, and Africa.

BASF SE: BASF SE (BASF) is one of the leading chemical producers in the world. The company is a market pioneer in driving the transition to net zero CO2 emissions with a comprehensive carbon management strategy. It has strong innovation using a wide range of technology to offer solutions for different industries of customers and to boost productivity. The company operates its business through six divisions: materials, industrial solutions, chemicals, surface technologies, agricultural solutions, and nutrition and care. It offers polymer resins across all sectors including packaging & oil & gas sector.

The company operates its business through 11 divisions that manage 54 global and regional business units and develop strategies for 72 strategic businesses. BASF marks its presence in 80 countries and operates through six Verbund sites, which interlink the working of production plants, energy flows, and infrastructure in different regions. It has around 240 manufacturing units worldwide including Ludwigshafen, Germany, the world’s largest integrated chemical complex owned by a single company. BASF primarily operates in Europe and has an active presence in the Americas, Asia-Pacific, the Middle East & Africa.

It serves around 82,000 customers from almost all sectors across the globe.