Expansion in Construction Sector

The ongoing expansion in the construction sector is a pivotal driver for the Polyols And Polyurethane Market. Polyurethane materials are increasingly utilized in insulation, flooring, and roofing applications due to their superior thermal properties and durability. The construction industry's growth, particularly in emerging economies, is expected to propel the demand for polyurethane products. Recent data indicates that the construction sector is anticipated to grow at a rate of approximately 5% annually, which will likely translate into increased consumption of polyols and polyurethanes. This trend underscores the critical role of the construction industry in shaping market dynamics.

Increasing Use in Consumer Goods

The increasing use of polyols and polyurethanes in consumer goods is a notable driver for the Polyols And Polyurethane Market. Products such as mattresses, furniture, and footwear are increasingly incorporating polyurethane materials due to their comfort, durability, and versatility. The consumer goods sector is experiencing a shift towards high-performance materials that enhance product quality and user experience. Market analysis indicates that the demand for polyurethane in consumer goods is expected to grow at a rate of 6% annually, reflecting a broader trend towards innovative and high-quality products. This growth is likely to have a substantial impact on the overall market landscape.

Rising Demand for Eco-Friendly Products

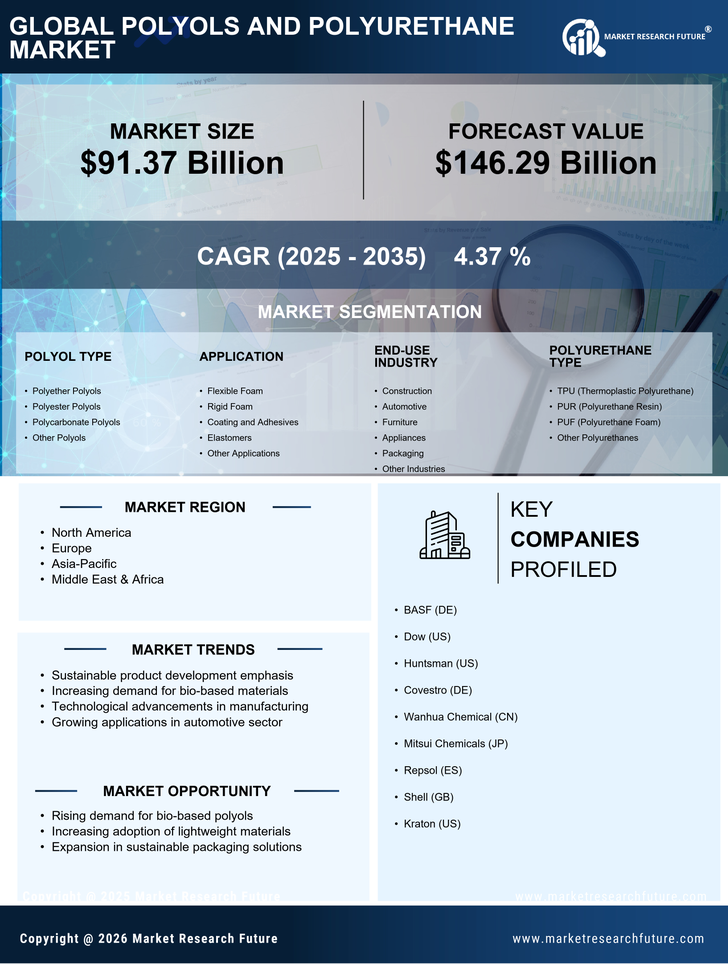

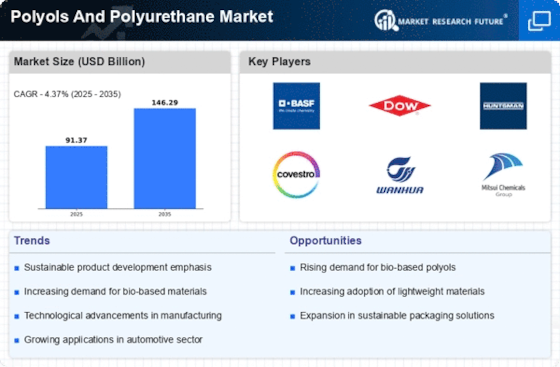

The increasing consumer preference for sustainable and eco-friendly products is driving the Polyols And Polyurethane Market. As environmental concerns gain prominence, manufacturers are focusing on developing bio-based polyols derived from renewable resources. This shift not only meets consumer expectations but also aligns with regulatory frameworks aimed at reducing carbon footprints. The market for bio-based polyols is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a robust demand for sustainable alternatives in the polyurethane sector, thereby enhancing the overall market landscape.

Technological Innovations in Production

Technological innovations in the production of polyols and polyurethanes are significantly influencing the Polyols And Polyurethane Market. Advances in manufacturing processes, such as the development of more efficient catalysts and reaction conditions, are enhancing product quality and reducing production costs. These innovations not only improve the performance characteristics of polyurethanes but also enable manufacturers to meet stringent regulatory standards. The introduction of new formulations and processing techniques is expected to drive market growth, with projections indicating a potential increase in market size by 15% over the next five years. This evolution in technology is crucial for maintaining competitiveness in the industry.

Growth in Automotive and Transportation Applications

The growth in automotive and transportation applications is a key driver for the Polyols And Polyurethane Market. Polyurethane materials are increasingly used in vehicle interiors, seating, and insulation due to their lightweight and energy-absorbing properties. As the automotive industry shifts towards more fuel-efficient and electric vehicles, the demand for lightweight materials is expected to rise. Recent statistics suggest that the automotive sector is projected to expand by 4% annually, which will likely boost the consumption of polyols and polyurethanes. This trend highlights the importance of the automotive industry in driving market demand.