Market Trends

Key Emerging Trends in the Polypropylene Catalyst Market

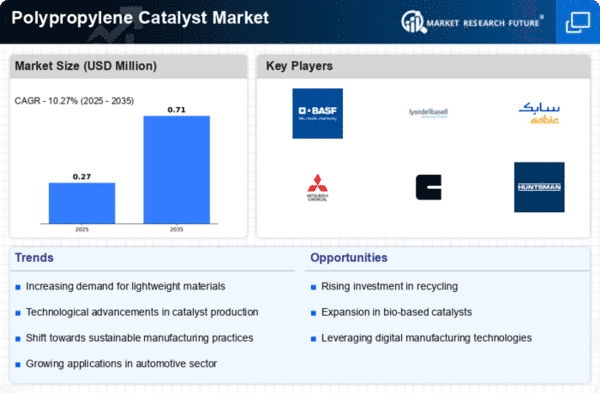

The Polypropylene Catalyst Market is facing the influence of emerging patterns of which the market shape is changing and therefore the industry is being redirected. The industry records the market demand ofpolypropylene catalysts, that is, currently there is an increase in the applications of polypropylene, because of the fact that polypropylene has many sectors such as industries, manufacturing, and packaging. Being a universal polypropylene thermoplastic polymer, its dramatic use involve in packaging, automotive, construction and healthcare fields. The growing range of end-use areas dictates the development of excellent catalysts for the polypropylene manufacture processes.

Because of these factors, a vital trend in the Polypropylene Catalyst Market is that the companies are centering the sustainable performance and environmental concerns. As more and more people are getting familiar with the ecological effect of plastic production, many manufacturers will be looking for alternatives that allow production of polypropylene with minimal environmental impact (footprint). This trend is consistent with the growing tendency all over the world to behave more responsible and, consequently, is encouraging catalyst, manufacturers to think and invent of ‘going green’ solutions. This paves the way for catalysts that promote efficient and sustainable raw material production, which has started to gain popularity among professionals.

The rise of catalysts, which are sited as the prime example of the emergence of the latest tech, is also an important development. In the meantime, the industry is engaged in constant innovation whereby active catalysts are being created and optimized to enhance the efficiency and the cost effectiveness of the polypropylene production. CAT manufacturers are sponsoring innovations in highly technical methodologies so as to make the catalytic process, selectivity and stability more efficient. This elicitary creates a space for increasing demand for high-performance catalysts which also encourages innovation in the market. This results in the manufacturers having an added advantage in terms of competitiveness.

The polypropylene catalyst market, being susceptible to geographic expansion, is conveyed through the development of polypropylene capacities. In this regard, as developing countries experience sudden industrialization and construction scale-up, need for polypropylene increases. As a result, the development of the nodes has become the main issue, where production plants are meant to be relocated to those regions with high opportunities for growth. As a result, the Polypropylene Catalyst Market is being subject to a change of manufacturing locations, seeing key players actively “building” their territoriality in developing markets towards the increasing needs of polypropylene catalysts.

Furthermore, in polyphenylene catalyst market joint ventures and partnerships are fast becoming mainstream. Owing to this, online retailing is evolving as parallel marketing channels and manufacturers are getting together with research institutions, technology suppliers, and other stakeholders for sourcing and sharing the resources, and expertise among them. Additionally, collaborations is expected to speed up the making of competitive catalyst compositions as well as enhances the adoption of one mind to the challenges in industry. Growing the scope for alliances are sure to give way to knowledge transfer and as well to ensure a better approach for the polypropylene catalyst market.

Leave a Comment