Market Share

Polypropylene Catalyst Market Share Analysis

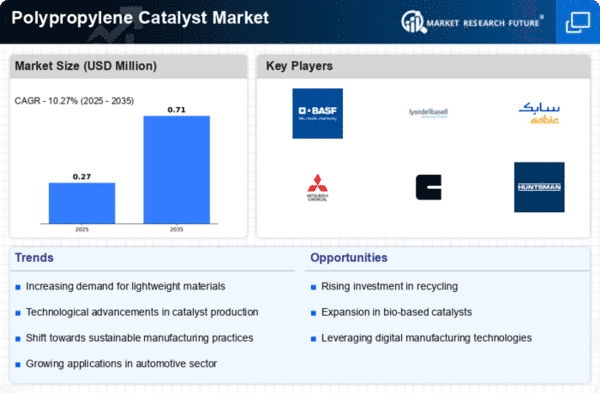

The Polypropylene Catalyst Market, one of the important segments in general chemical industry, is driven by many market share positioning strategies which are dynamic in nature. Polypropylene, a ubiquitous polymer, is widely used for packaging, automotive applications, textiles and other industries. This segmented market, however, calls for different approaches as companies try to gain and retain their market share.

One of the popular strategies is to stress on the technology innovation. Companies will invest much money in research and development to come up with cutting-edge catalyst technology that improves both the precision and the quality of polypropylene production. Being on the cutting edge of innovation can help companies to stand out, offering those who seek solutions that are not only superior but also environmentally friendly. This strategy achieves not only the gain of a significant market share but also the brand position as an advance technology industry leader.

However, in the Polypropylene Catalyst Market, one of the important strategic positioning approaches is forming strategic alliances and partnerships. Many firms cooperate with suppliers of raw materials, research institutions and sometimes their competitors in order to obtain synergies and share their combined knowledge. Synergies can culminate in catalytic formulations that are newly developed, manufacturing that is enhanced, and cost-effective solutions. By forming strategic alliances, businesses are able to broaden their market reach, share knowledge, and tackle problems jointly, thus ensuring global market position.

Cost leadership is an important aspect of marketing share positioning in the Polypropylene Catalyst Market. Those companies whose products are good quality and at a competitive price mostly gets this edge. This strategy needs a strong emphasis on operational efficiency, economies of scale, and an effective supply chain. Through cost leadership companies can attract cost-conscious customers and procure a greater market share, especially in price-oriented segments of the industry.

Market segmentation is one of the significant strategies that Polypropylene Catalyst Market uses. Organizations can prioritize certain application sectors or geographic regions where the need for polypropylene is higher. Through the development and targeted marketing that meet the unique needs of different market segments, companies are able to get considerable share in the specific niches. This tactic maximizes the utilization of resources and helps to keep up with the consumers' demands.

Leave a Comment