Polypropylene Catalyst Size

Polypropylene Catalyst Market Growth Projections and Opportunities

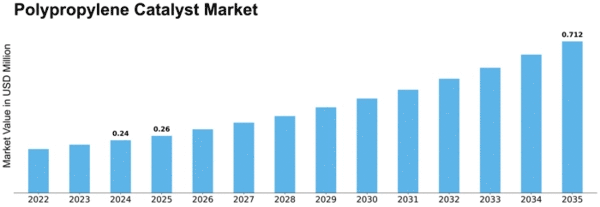

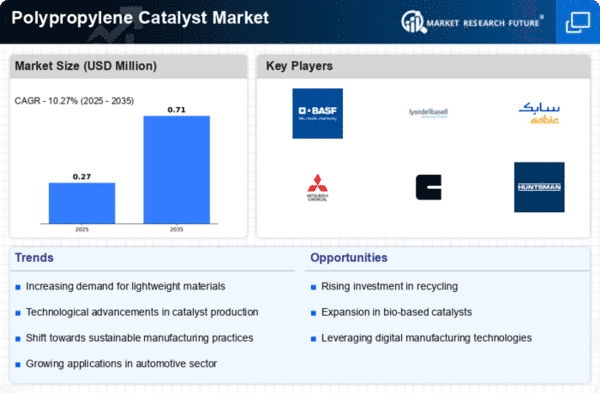

It is expected that the Polypropylene Catalyst Market to be valued at USD 2806.8 Million by the year 2030, this is derived from the CAGR of 10% during the forecast period of 5 years, i.e., (2021 – 2030).

The diverse forces that drive the competitive landscape in the polypropylene catalyst market play a crucial part in determining the market dynamics of this industry. One of the most important influencers of the polypropylene price is the load factor which refers to the growth or decline of demand for demand for polypropylene, a multipurpose polymer which is widely used in various industries. While developments in industries like packaging, automobiles, and textiles are delving deep, so is the requirement for polypropylene, that further creates a demand for polypropylene catalysts. In addition to this, economic conditions greatly influence the market too since the shifts in the global economic quality can create problems with manufacturing activities and demand of PP-based product.

Apart from this, the techno evolution of catalyst development is another significant factor. In the field of catalysis research and innovation is focused on improving polypropylene manufacturing processes further. Catalyst efficiency, selectivity, and sustainability of manufacturing processes are of significant importance as they form the basis of becoming competitive in the market. Regulatory considerations complement this environment, with the rules peculiar to environmental protection in the driver's seat. The high level of consciousness among the stakeholders about the sustainability and environmental concerns leads the industry to invent the cleaner eco-friendly catalyst that meets the high level of regulation.

However, the availability and the cost of raw materials, the so-called raw materials, have a bearing on the polypropylene catalyst market as well. The main raw materials used in catalyst production include metals, chemicals and additives followed by grinding and shredding of these raw materials. Change of prices in the donor materials used in catalyst production may impact overall costs, which in turn may affect market prices and possibly company profitability. Fluctuations of the price in the raw materials or geopolitical events are also factors that increase the volatility of the market and, by the same token, the uncertainty.

The competitive dynamics within the industry itself are one of the most crucial market factors. to consider. Presence of these major players, the extent of their dominance in the market, and their capability to innovate give rise to the overall competitive outlook of the polypropylene catalyst market. Companies frequently have researches and developments, mergers and acquisitions, alliances and others as methods of improvement of their competitive position. Companies can choose pricing strategies and levels of product innovation depending on the level of competition. This, in turn, shapes the market.

Continously changing market demand together with client preferences lead to a top market displacement for polypropylene catalyst. Consumer habits, for example, uprising demand for green and recycles goods, determine the kind of polypropylene products sought by customers. Producers have to favor their production accordingly in order to adjust themselves with these new consumer trends and be accepted by the market. Moreover, regional demarcations in demand patterns and regulation, as well, contribute to the complexity of the market dynamics.

Leave a Comment