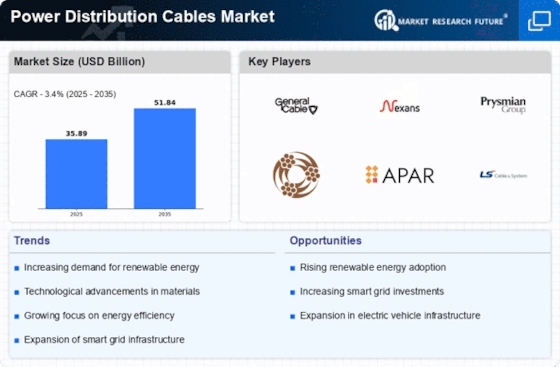

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the Power Distribution Cables Market. As countries strive to meet energy transition goals, the integration of solar and wind energy into existing grids necessitates robust power distribution systems. This shift is expected to result in a substantial increase in demand for power distribution cables, which are essential for connecting renewable energy sources to the grid. According to recent estimates, the renewable energy sector is projected to grow at a compound annual growth rate of over 8%, further propelling the need for efficient power distribution solutions. Consequently, manufacturers are focusing on developing cables that can withstand the unique challenges posed by renewable energy integration, thereby enhancing their market presence.

Increased Focus on Energy Efficiency

The growing emphasis on energy efficiency is a crucial driver for the Power Distribution Cables Market. As energy costs rise and environmental concerns mount, both consumers and businesses are seeking ways to reduce energy consumption. This trend is prompting utilities to invest in more efficient power distribution systems, which include high-performance cables designed to minimize energy losses. The market is witnessing a shift towards cables that comply with stringent energy efficiency standards, which are becoming increasingly prevalent across various regions. According to industry reports, the energy efficiency market is expected to grow significantly, with power distribution cables playing a vital role in achieving these goals. Consequently, the focus on energy efficiency is likely to propel demand for innovative cable solutions that align with sustainability objectives.

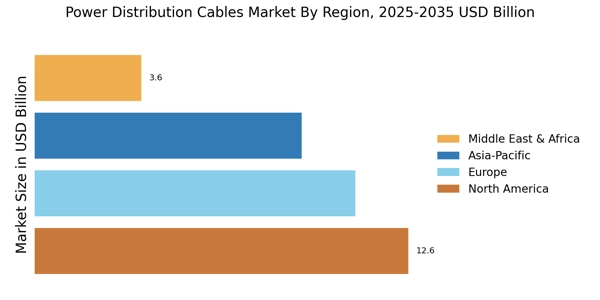

Government Initiatives and Investments

Government initiatives aimed at enhancing energy infrastructure are significantly impacting the Power Distribution Cables Market. Many governments are investing in upgrading aging electrical grids to improve reliability and efficiency. These initiatives often include financial incentives for utilities to adopt modern power distribution technologies. For instance, various countries have launched programs to promote the use of underground cables, which are less susceptible to environmental disruptions. Such investments are expected to create a favorable environment for the growth of the power distribution cables market. Furthermore, regulatory frameworks that encourage the adoption of smart grid technologies are likely to stimulate demand for advanced power distribution solutions, thereby benefiting manufacturers in the sector.

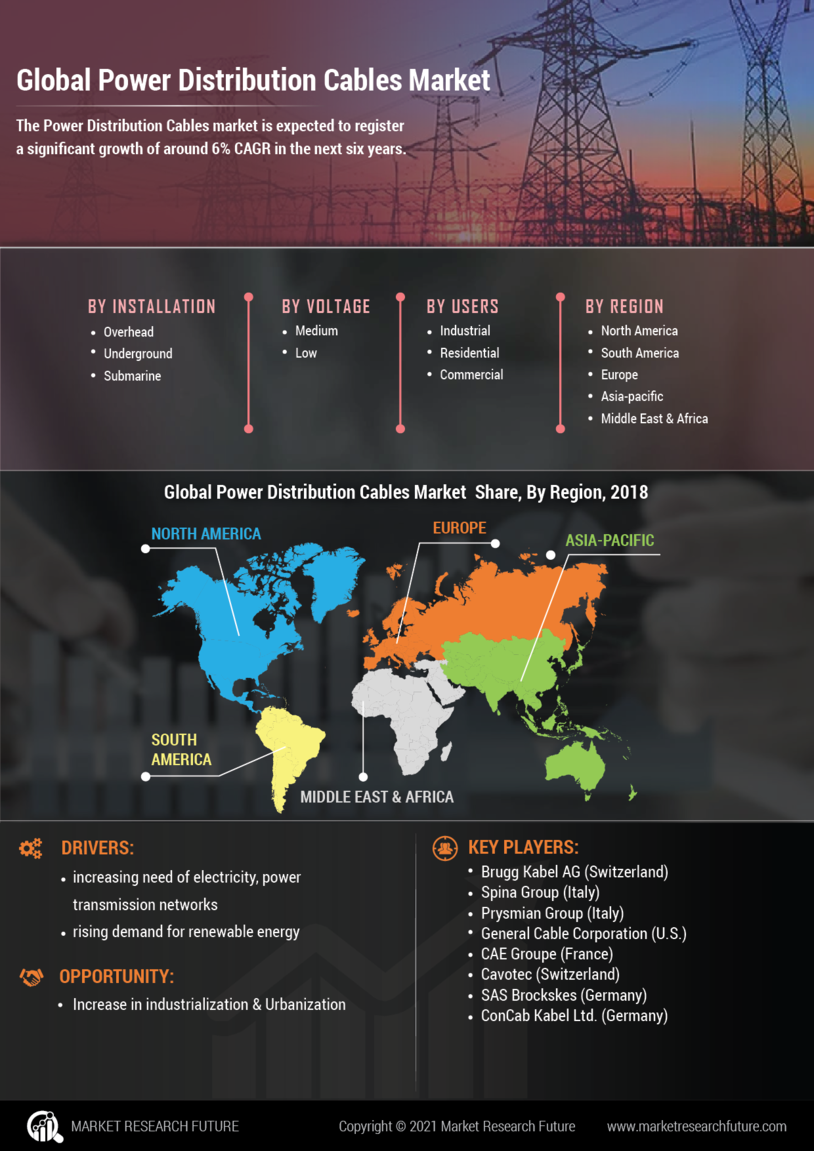

Urbanization and Infrastructure Development

Rapid urbanization and ongoing infrastructure development are pivotal factors influencing the Power Distribution Cables Market. As urban areas expand, the demand for reliable electricity supply increases, necessitating the installation of advanced power distribution systems. This trend is particularly evident in emerging economies, where urban populations are projected to rise significantly in the coming years. The International Energy Agency indicates that electricity demand in urban areas could increase by 50% by 2030. This surge in demand compels utility companies to invest in modern power distribution cables that can efficiently manage higher loads and ensure uninterrupted service. Thus, the growth of urban centers is likely to create lucrative opportunities for manufacturers in the power distribution cables sector.

Technological Innovations in Cable Manufacturing

Technological advancements in cable manufacturing are reshaping the Power Distribution Cables Market. Innovations such as the development of high-temperature superconductors and advanced insulation materials are enhancing the performance and efficiency of power distribution cables. These innovations not only improve the durability and lifespan of cables but also reduce energy losses during transmission. The market is witnessing a shift towards smart cables equipped with monitoring systems that provide real-time data on performance and potential failures. This trend is expected to attract investments, as utilities seek to modernize their infrastructure to accommodate growing energy demands. As a result, the integration of cutting-edge technologies in cable manufacturing is likely to drive market growth and enhance competitive dynamics.