Research Methodology on Power Electronics Market

Introduction

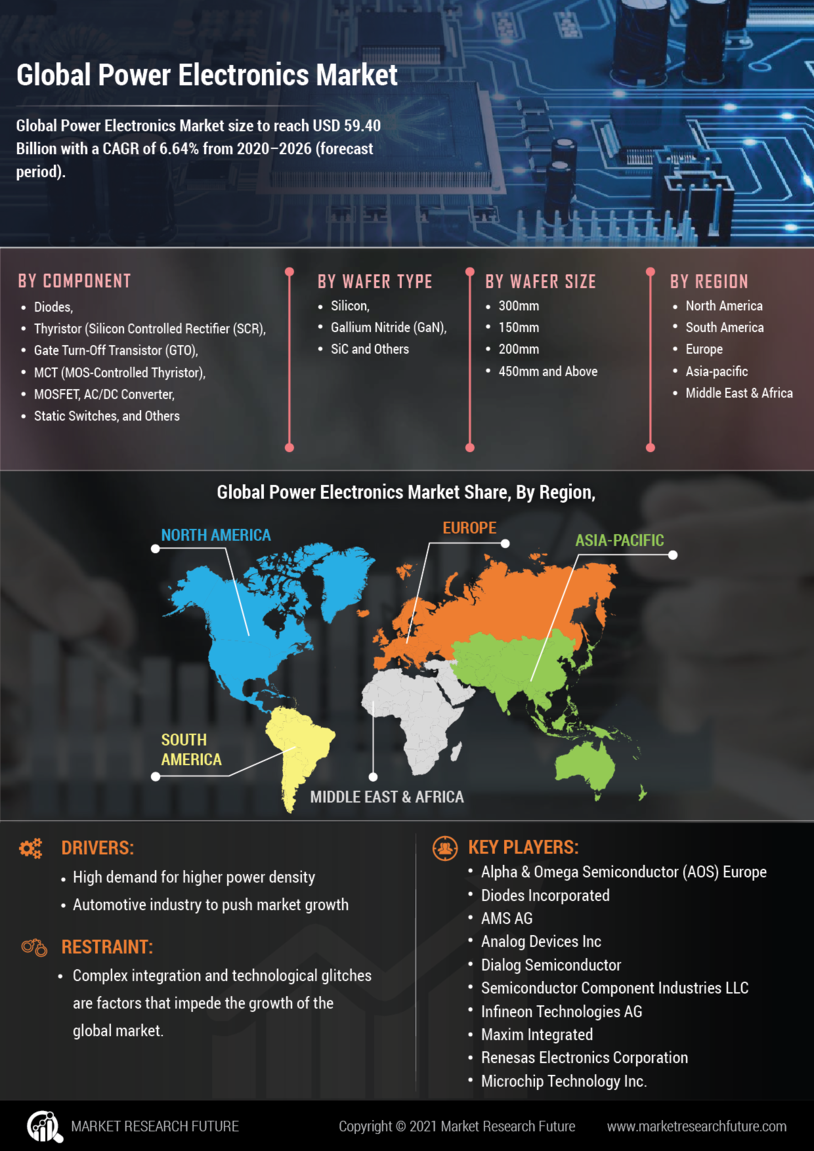

Power electronics is a field of study and research focused on the application of electronic control mechanisms to regulate and convert power in the form of electricity. Power electronics are used to control electrical equipment such as variable speed drives, AC drives, motor controllers, inverters and motor starters. The Power Electronics market is mainly driven due to their usage in day-to-day applications.

This research study focuses on exploring the present and future trends of the Power Electronics market and analyzing various market segments and their growth trends. This research report also attempts to analyze the competitive landscape of the Power Electronics market and identify key competitors in the market.

Research Methodology

This research study aims to analyze the Power Electronics market and its growth trends in the projected future. For this, a systematic and rigorous research methodology is adopted. The research methodology consisted of a two-step approach. The first step involves secondary research using books, journals, reports, and websites. This aided in validating the primary objectives and getting a better idea of the risks and opportunities available in the segment. The second step involves primary research in the form of interviews with industry experts, market leaders, and stakeholders.

Secondary Research

For this research, a range of secondary research sources is used to get a qualitative understanding of the key factors influencing the Power Electronics market. Various sources such as industry reports, product reviews, interviews, blogs and surveys are accessed and analyzed. This is further collated and analyzed to identify the opportunities and risks associated with the Power Electronics market.

Primary Research

In the primary research, interviews and discussions with industry experts, market leaders, and stakeholders are conducted. The purpose of these discussions was to obtain an in-depth understanding of the industry, its current trends and the mood of the market concerning the future of Power Electronics.

These interviews helped in validating the data derived from secondary research and further enabled the exploration of more detailed topics related to the Power Electronics market. Questions are asked to industry experts, market leaders and stakeholders regarding their insights into growth and challenges, drivers, and industry trends.

Aanalysis

The data collated from primary and secondary research is analyzed to identify the opportunities and risks associated with the Power Electronics market. The sources of the data are cross-checked and validated in order to draw meaningful and accurate conclusions. The research findings are further used to develop strategies and recommendations for the market players and the market as a whole.

Conclusion

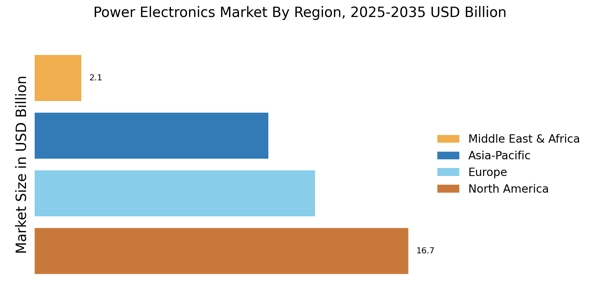

Based on the analysis of the Power Electronics market, it can be concluded that the market is driven by several factors such as technological advancements, increasing demand for renewable energy, and government incentives. The report highlights the key market players, their strategies, and the competitive landscape of the market. The data gathered through rigorous primary and secondary research provides an in-depth analysis of the market and can be used to develop strategies for successful market entry and sustainable market growth.