Expansion of Renewable Energy Sources

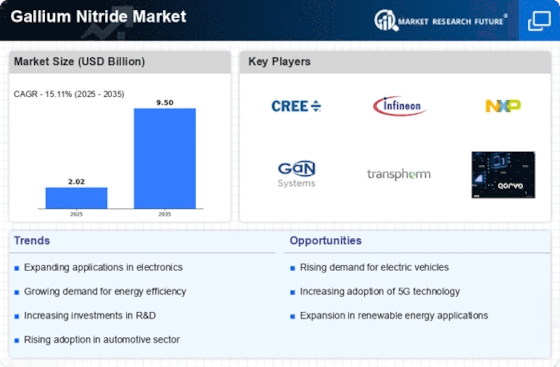

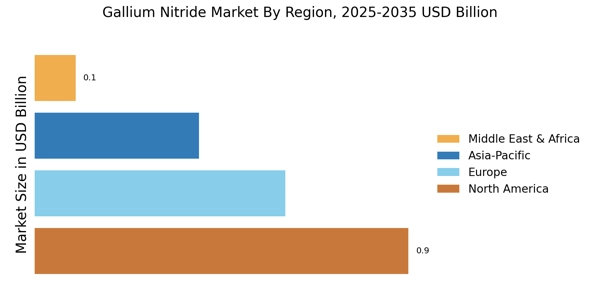

The transition towards renewable energy sources is significantly influencing the Gallium Nitride Market. As countries aim to reduce carbon emissions, the integration of solar and wind energy systems is becoming more prevalent. Gallium nitride devices are essential in power management systems, enabling efficient energy conversion and storage. The market for renewable energy is expected to witness a CAGR of approximately 15% over the next decade, which may lead to increased investments in gallium nitride technologies. This expansion indicates a promising future for the Gallium Nitride Market, as it aligns with global sustainability goals and the need for efficient energy solutions.

Increasing Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is a pivotal driver for the Gallium Nitride Market. As automakers strive to enhance the efficiency and performance of EVs, the demand for advanced power electronics is surging. Gallium nitride, with its superior thermal conductivity and efficiency, is increasingly utilized in power converters and chargers. Reports indicate that the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years, thereby propelling the demand for gallium nitride components. This trend suggests that the Gallium Nitride Market is likely to experience substantial growth as manufacturers seek to meet the evolving needs of the automotive sector.

Rising Demand for High-Power Applications

The increasing demand for high-power applications is a significant driver for the Gallium Nitride Market. Industries such as aerospace, defense, and industrial automation require power devices that can handle high voltages and currents efficiently. Gallium nitride's ability to operate at higher power levels with reduced energy losses makes it an ideal choice for these applications. The high-power electronics market is projected to grow at a CAGR of around 12% over the next several years, suggesting a robust demand for gallium nitride solutions. This trend highlights the potential for the Gallium Nitride Market to expand as it caters to the needs of high-performance applications.

Growth in Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure is a crucial driver for the Gallium Nitride Market. With the rollout of 5G networks, there is a heightened demand for high-frequency components that can handle increased data transmission rates. Gallium nitride is favored for its ability to operate at higher frequencies and power levels, making it ideal for 5G base stations and other communication devices. The telecommunications sector is projected to grow at a CAGR of around 10% in the next few years, which could lead to a significant uptick in the adoption of gallium nitride technologies. This growth trajectory suggests that the Gallium Nitride Market will play a vital role in supporting the next generation of communication technologies.

Technological Advancements in Semiconductor Manufacturing

Technological advancements in semiconductor manufacturing processes are driving innovation within the Gallium Nitride Market. The development of new fabrication techniques has enabled the production of gallium nitride devices that are more efficient and cost-effective. As semiconductor manufacturers invest in research and development, the performance of gallium nitride components continues to improve, making them more attractive for various applications. The semiconductor market is anticipated to grow at a CAGR of approximately 8% in the coming years, which may further bolster the demand for gallium nitride technologies. This trend indicates that the Gallium Nitride Market is poised for growth as manufacturers seek to leverage these advancements.