Emergence of Smart Mobility Solutions

The Automotive Power Electronics Market is being transformed by the emergence of smart mobility solutions. As urbanization accelerates, there is a growing need for innovative transportation systems that are efficient and sustainable. Power electronics play a pivotal role in enabling smart mobility by facilitating vehicle-to-grid communication, energy management, and integration with renewable energy sources. In 2025, the market for power electronics in smart mobility applications is projected to grow at a rate of 10%, reflecting the increasing investment in smart infrastructure. This trend indicates a shift towards more interconnected and efficient transportation systems, where power electronics are integral to achieving operational efficiency and sustainability.

Increasing Demand for Energy Efficiency

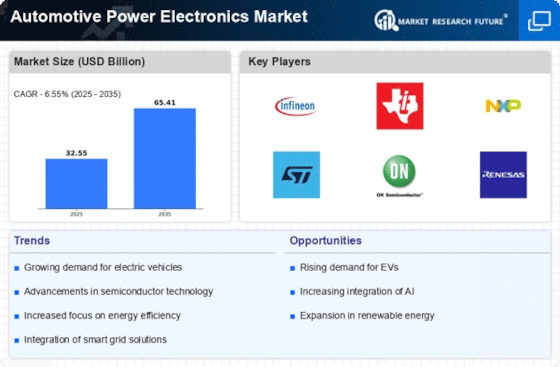

The Automotive Power Electronics Market is experiencing a notable surge in demand for energy-efficient solutions. As consumers become more environmentally conscious, automakers are compelled to enhance the energy efficiency of their vehicles. This trend is reflected in the growing adoption of power electronics, which facilitate better energy management and reduce overall energy consumption. In 2025, the market for power electronics in automotive applications is projected to reach approximately USD 20 billion, driven by the need for improved fuel economy and reduced emissions. The integration of advanced power electronics enables vehicles to optimize energy usage, thereby appealing to a broader consumer base that prioritizes sustainability.

Regulatory Push for Emission Reductions

The Automotive Power Electronics Market is also shaped by stringent regulatory frameworks aimed at reducing vehicular emissions. Governments worldwide are implementing policies that mandate lower emissions from vehicles, thereby driving the adoption of power electronics technologies. These regulations often require automakers to integrate advanced power management systems that enhance vehicle efficiency and reduce carbon footprints. As of 2025, it is estimated that compliance with these regulations will contribute to a market growth rate of approximately 8% annually. This regulatory push not only fosters innovation in power electronics but also encourages manufacturers to invest in research and development to meet evolving standards.

Growth of Autonomous Vehicle Technologies

The Automotive Power Electronics Market is poised for growth due to the rise of autonomous vehicle technologies. As vehicles become increasingly automated, the demand for advanced power electronics systems that support complex functionalities is on the rise. These systems are essential for managing the power requirements of sensors, cameras, and computing units that enable autonomous driving. By 2025, the market for power electronics in autonomous vehicles is expected to expand significantly, potentially reaching USD 15 billion. This growth is indicative of the automotive industry's shift towards integrating sophisticated technologies that enhance safety and driving experience, thereby necessitating robust power electronics solutions.

Advancements in Electric Vehicle Technology

The Automotive Power Electronics Market is significantly influenced by advancements in electric vehicle (EV) technology. As the automotive sector shifts towards electrification, the demand for sophisticated power electronics systems is escalating. These systems are crucial for managing battery performance, enhancing charging efficiency, and ensuring the overall reliability of EVs. In 2025, it is anticipated that the EV segment will account for over 30% of the total automotive power electronics market, underscoring the critical role of power electronics in the transition to electric mobility. The continuous innovation in semiconductor materials and circuit design further propels this growth, enabling manufacturers to produce more efficient and compact power electronics solutions.