Regulatory Compliance Pressure

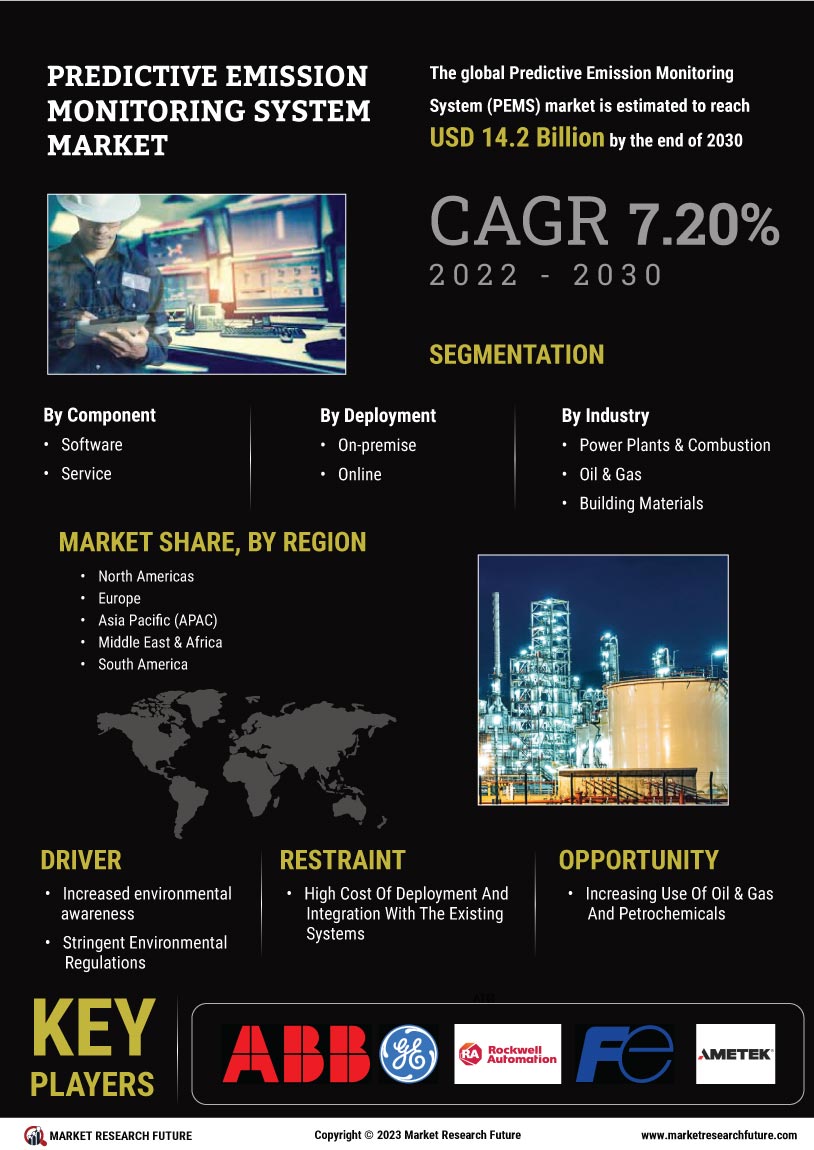

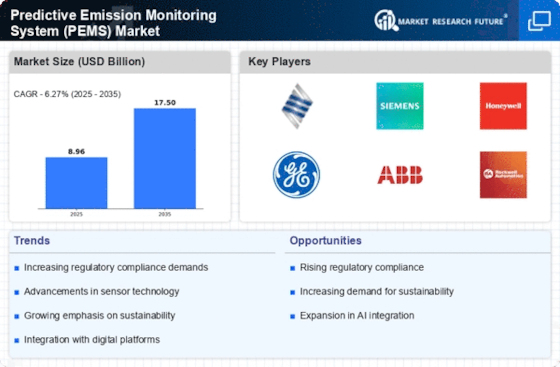

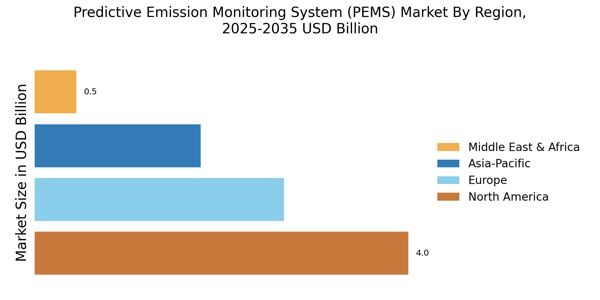

The Predictive Emission Monitoring System Market (PEMS) Market is experiencing heightened pressure from regulatory bodies to comply with stringent emission standards. Governments worldwide are implementing more rigorous environmental regulations, necessitating the adoption of advanced monitoring systems. This trend is particularly evident in sectors such as power generation and manufacturing, where emissions are closely scrutinized. As a result, companies are increasingly investing in PEMS to ensure compliance and avoid hefty fines. The market is projected to grow as organizations seek to align with these regulations, which are expected to become even more stringent in the coming years. This compliance-driven demand is likely to propel the PEMS market forward, as businesses recognize the importance of maintaining operational integrity while adhering to environmental standards.

Growing Environmental Awareness

There is a notable increase in environmental awareness among consumers and businesses alike, which is significantly influencing the Predictive Emission Monitoring System Market (PEMS) Market. As stakeholders become more conscious of their environmental impact, there is a growing demand for technologies that can accurately monitor and reduce emissions. This shift is prompting industries to adopt PEMS as a proactive measure to demonstrate their commitment to sustainability. According to recent data, the market for emission monitoring systems is expected to expand at a compound annual growth rate of over 10% in the next five years. This growth is indicative of a broader trend where organizations are prioritizing environmental responsibility, thereby driving the adoption of PEMS to enhance their operational transparency and accountability.

Rising Demand from Industrial Sectors

The Predictive Emission Monitoring System Market (PEMS) Market is witnessing a rising demand from various industrial sectors, including manufacturing, energy, and transportation. These sectors are increasingly adopting PEMS to monitor emissions and improve operational efficiency. The need for accurate emission data is becoming paramount as industries face mounting pressure to reduce their carbon footprint. Recent statistics indicate that the manufacturing sector alone accounts for a significant portion of global emissions, prompting companies to invest in PEMS to mitigate their environmental impact. This trend is expected to continue, with industries recognizing that effective emission monitoring is not only a regulatory requirement but also a competitive advantage in an increasingly eco-conscious market.

Increased Investment in Clean Technologies

Investment in clean technologies is a significant driver for the Predictive Emission Monitoring System Market (PEMS) Market. As governments and private sectors allocate more resources towards sustainable practices, the demand for PEMS is expected to surge. This trend is particularly pronounced in industries such as oil and gas, where emissions monitoring is critical for operational efficiency and regulatory compliance. Recent reports indicate that investments in clean technology are projected to reach unprecedented levels, with billions of dollars earmarked for emission reduction initiatives. Consequently, the PEMS market is likely to experience robust growth as organizations seek to leverage these technologies to enhance their environmental performance and meet regulatory requirements.

Technological Advancements in Monitoring Solutions

The Predictive Emission Monitoring System Market (PEMS) Market is benefiting from rapid technological advancements in monitoring solutions. Innovations in sensor technology, data analytics, and cloud computing are enhancing the capabilities of PEMS, making them more efficient and reliable. These advancements allow for real-time monitoring and predictive analytics, enabling organizations to anticipate potential emission issues before they arise. As industries increasingly recognize the value of data-driven decision-making, the demand for sophisticated PEMS is likely to rise. Market analysts suggest that the integration of artificial intelligence and machine learning into PEMS could further revolutionize the industry, providing deeper insights into emission patterns and facilitating more effective management strategies.