Research Methodology on Pressure Vessel Market

Introduction

The purpose of this report is to provide an in-depth analysis of the pressure vessel market and its importance in the global economy. It explores the market dynamics and trends, as well as industry insights in order to gauge current opportunities and future prospects in the sector. Key segments, such as the type of product, the material variants, industry verticals, geographical regions, and end-user applications, are studied in detail. Further, macroeconomic indicators, such as imports and exports, production capacities, market shares, and developments in the distribution channels, are rigorously analyzed to understand the dynamics of the global pressure vessel market.

Literature Review

The literature review presents an overview of the market, with a particular focus on the various factors that drive and restrain the market. Relevant literature published in the form of books, journals, articles, and other academic sources can provide an understanding of the emerging trends in the market. The primary sources of information include industry surveys, reviews of primary and secondary literature, and interviews with market stakeholders. The secondary sources of information employed for this research include industry reports, white papers, and other related sources. The collected literature was used to provide an in-depth understanding of the pressure vessel market and its implications for the global economy.

Research Methodology

The research methodology employed in this report is based on a robust data collection process. Primary data was collected from industry experts and market participants, while secondary data was sourced from websites, journals, and other sources. The data gathered was analysed using different methods such as qualitative and quantitative methods. The quantitative method, involving data collected from surveys, questionnaires, and interviews, was used to analyse and construct the market shares. The qualitative method was used to identify industry trends, market drivers, and global market developments.

The research methodology also included the use of Porter’s five forces model, a tool that allows for a better understanding of the competitive forces present in the global market. Furthermore, the SWOT analysis was used to assess the market strengths, weaknesses, opportunities, and threats.

The report also includes data collected from primary and secondary sources, such as government agencies, industry associations, investment banks, trade journals, and other industry sources. The data was collected through extensive primary and secondary research, which was then analysed using both qualitative and quantitative methods.

Results and Discussion

The results of the research presented in this report suggest that the global pressure vessel market is expected to witness robust growth in the near future, driven by several factors, including rising investments in the process industries, regulatory reforms, technological innovation, and changes in the market dynamics. The industry is dominated by a few major players, such as Larsen & Toubro Limited, Yokogawa Electric Corporation, Mitsubishi Heavy Industries Ltd, Sulzer Ltd, Bharat Heavy Electricals Ltd, Doosan Heavy Industries & Construction, and other players. The different product types that are driving demand include pulsation dampeners, expansion joints, sealing systems, and air boosters.

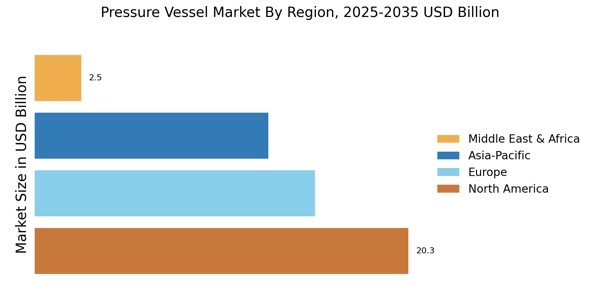

The different materials used in the manufacture of pressure vessels include stainless steel, alloy steel, and carbon steel, which are used in several applications such as oil and gas, chemical, power generation, and others. North America, Asia-Pacific, and Europe are the leading regional markets for the industry.

Conclusion

The rapidly escalating development in the process industries, particularly in emerging economies, is anticipated to create a positive outlook in the global pressure vessel market in the near future. The development of efficient and durable vessels using various materials, such as stainless steel, carbon steel, and alloy steel, to facilitate a variety of applications is projected to create lucrative opportunities in the industry. Moreover, the advent of innovative technologies, such as process analytics, is expected to further open up numerous growth opportunities in the global market.