Increasing Water Scarcity

The escalating issue of water scarcity is a critical driver for the Primary Water And Wastewater Treatment Equipment Market. As populations grow and urbanization intensifies, the demand for clean water surges. This situation compels municipalities and industries to invest in advanced treatment technologies to ensure sustainable water supply. According to recent data, nearly 2 billion people live in countries experiencing high water stress, which underscores the urgency for effective water management solutions. Consequently, the market for treatment equipment is likely to expand as stakeholders seek to enhance water recovery and reuse capabilities, thereby addressing the pressing challenges of water scarcity.

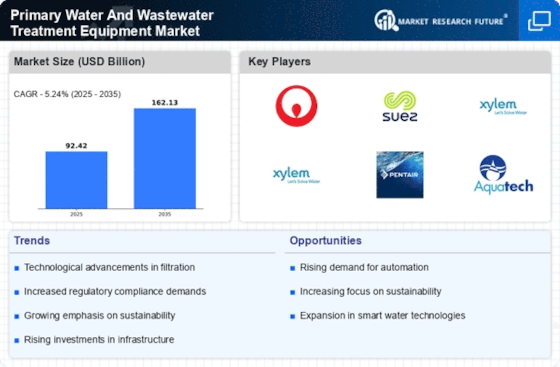

Technological Innovations

Technological advancements play a significant role in propelling the Primary Water And Wastewater Treatment Equipment Market. Innovations such as membrane filtration, advanced oxidation processes, and smart monitoring systems are revolutionizing the way water and wastewater are treated. These technologies not only enhance treatment efficiency but also reduce operational costs. For example, the integration of IoT in treatment facilities allows for real-time monitoring and data analytics, leading to optimized performance. As industries increasingly adopt these cutting-edge solutions, the market is poised for substantial growth, driven by the need for more efficient and effective treatment processes.

Rising Environmental Awareness

Growing environmental awareness among consumers and industries is a notable driver for the Primary Water And Wastewater Treatment Equipment Market. As public concern regarding pollution and resource depletion rises, there is a heightened demand for sustainable practices in water management. This shift in consumer behavior encourages companies to invest in eco-friendly treatment technologies that minimize environmental impact. Furthermore, organizations are increasingly recognizing the importance of corporate social responsibility, leading to greater investments in wastewater treatment solutions. Consequently, the market is likely to expand as stakeholders prioritize sustainable practices and seek to enhance their environmental stewardship.

Regulatory Compliance and Standards

Stringent regulations regarding water quality and wastewater discharge are pivotal in shaping the Primary Water And Wastewater Treatment Equipment Market. Governments and regulatory bodies worldwide are implementing more rigorous standards to protect public health and the environment. For instance, the introduction of the Clean Water Act in various regions mandates that wastewater treatment facilities meet specific effluent quality standards. This regulatory landscape compels industries to upgrade their treatment systems, driving demand for innovative equipment. As a result, the market is expected to witness growth as organizations strive to comply with these evolving regulations, ensuring that their operations align with environmental sustainability goals.

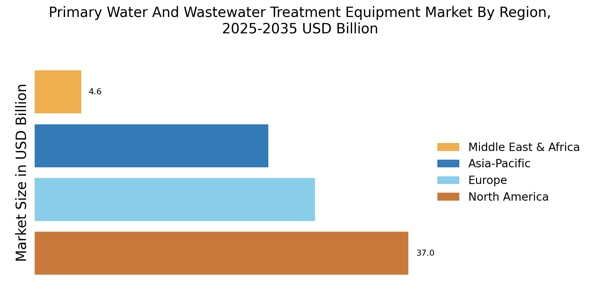

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are significant factors influencing the Primary Water And Wastewater Treatment Equipment Market. As cities expand, the demand for reliable water supply and effective wastewater management systems intensifies. This trend necessitates the construction and upgrading of treatment facilities to accommodate growing populations. According to estimates, urban areas are expected to house 68% of the world's population by 2050, further stressing existing water resources. In response, governments and private sectors are likely to invest heavily in treatment equipment, driving market growth as they seek to develop resilient infrastructure capable of meeting future water demands.