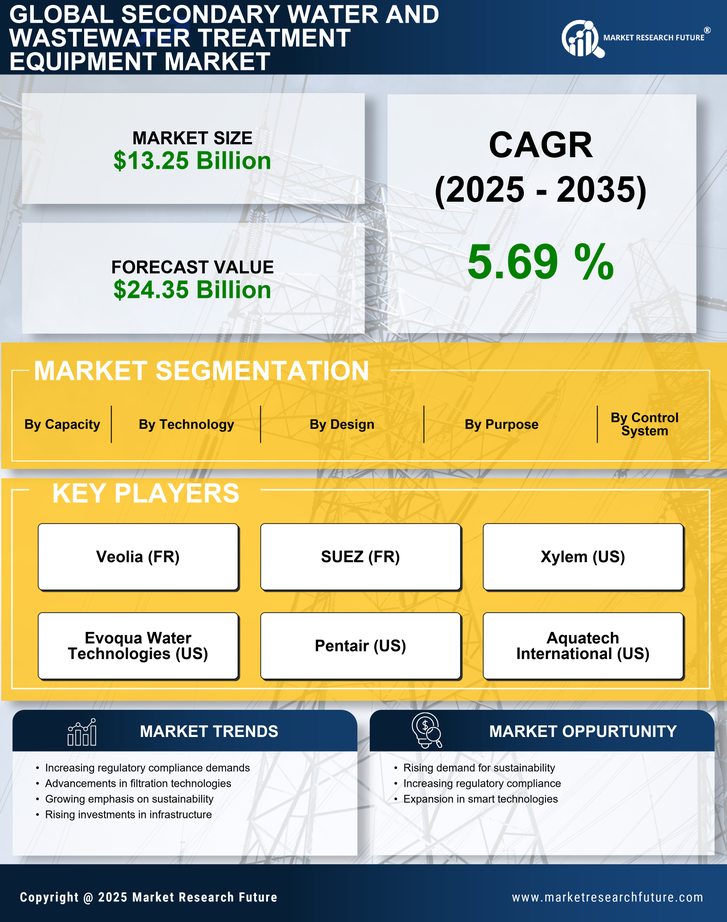

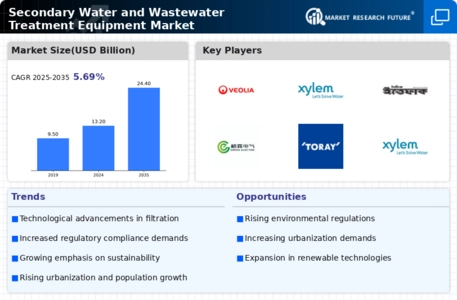

Regulatory Pressures

Regulatory frameworks are increasingly stringent, compelling industries to adopt advanced treatment solutions. The Secondary Water and Wastewater Treatment Equipment Market is significantly influenced by these regulations, which aim to protect public health and the environment. Compliance with standards set by environmental agencies necessitates the implementation of effective wastewater treatment technologies. As regulations evolve, industries are prompted to upgrade their equipment to meet new requirements. This trend is expected to drive market growth, as companies seek to avoid penalties and enhance their sustainability profiles. The increasing focus on regulatory compliance is likely to propel investments in the Secondary Water and Wastewater Treatment Equipment Market.

Increasing Water Scarcity

The escalating issue of water scarcity is a critical driver for the Secondary Water and Wastewater Treatment Equipment Market. As populations grow and urban areas expand, the demand for clean water intensifies. This situation compels municipalities and industries to invest in advanced treatment technologies to recycle and reuse water. According to recent data, approximately 2 billion people currently live in water-stressed regions, highlighting the urgent need for effective wastewater management solutions. The Secondary Water and Wastewater Treatment Equipment Market is poised to benefit from this trend, as more entities seek to implement sustainable practices that ensure water availability for future generations.

Technological Innovations

Technological advancements play a pivotal role in shaping the Secondary Water and Wastewater Treatment Equipment Market. Innovations such as membrane bioreactors, advanced oxidation processes, and smart monitoring systems enhance treatment efficiency and reduce operational costs. These technologies not only improve the quality of treated water but also facilitate compliance with stringent regulations. The market is witnessing a shift towards automation and digitalization, which streamlines processes and optimizes resource management. As industries and municipalities adopt these cutting-edge solutions, the demand for sophisticated treatment equipment is expected to surge, driving growth in the Secondary Water and Wastewater Treatment Equipment Market.

Rising Environmental Concerns

Heightened awareness of environmental issues significantly influences the Secondary Water and Wastewater Treatment Equipment Market. As pollution levels rise and ecosystems face degradation, there is an increasing push for cleaner water sources and effective wastewater management. Governments and organizations are prioritizing investments in treatment technologies that minimize environmental impact. The market is projected to grow as stakeholders recognize the importance of sustainable practices. For instance, The Secondary Water and Wastewater Treatment Equipment is expected to reach USD 500 billion by 2027, indicating a robust demand for innovative equipment that aligns with environmental goals. This trend underscores the necessity for advanced treatment solutions.

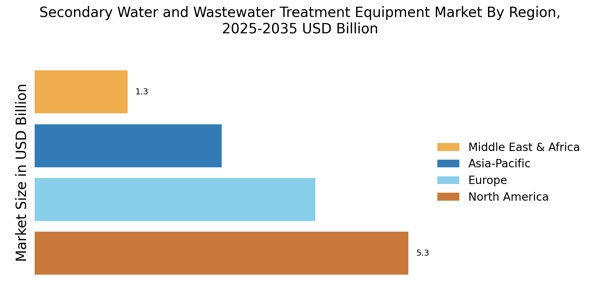

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are key factors driving the Secondary Water and Wastewater Treatment Equipment Market. As cities expand, the demand for efficient water and wastewater management systems becomes paramount. Urban areas require robust treatment solutions to handle increased wastewater generation and ensure the provision of clean water. The United Nations projects that by 2050, nearly 68% of the world population will reside in urban areas, intensifying the need for advanced treatment technologies. This demographic shift presents a substantial opportunity for the market, as municipalities and private sectors invest in modern infrastructure to support sustainable urban living.