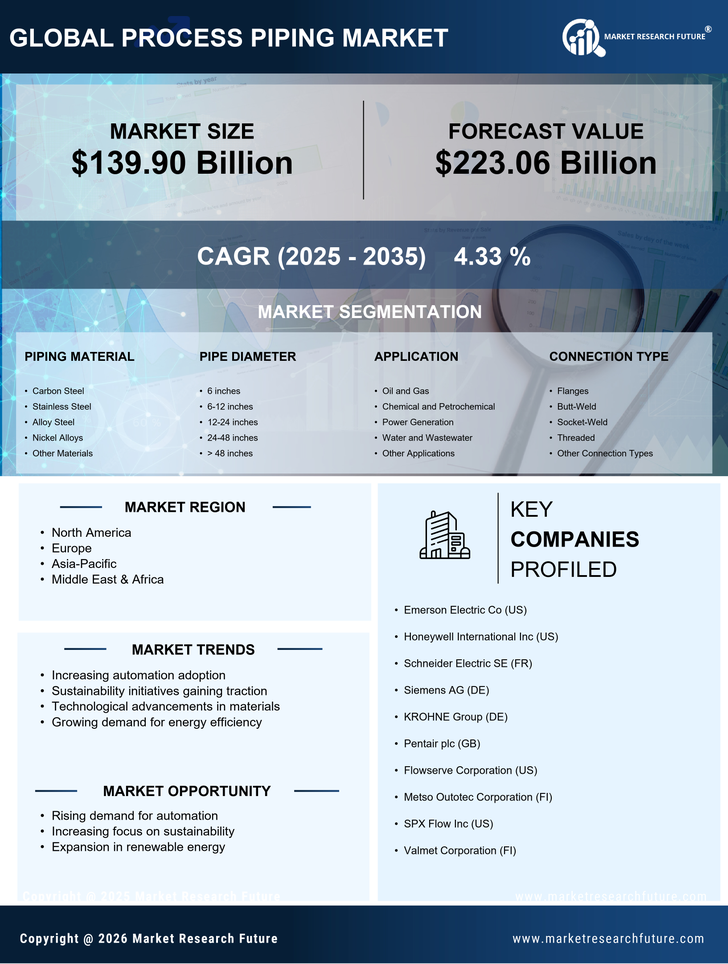

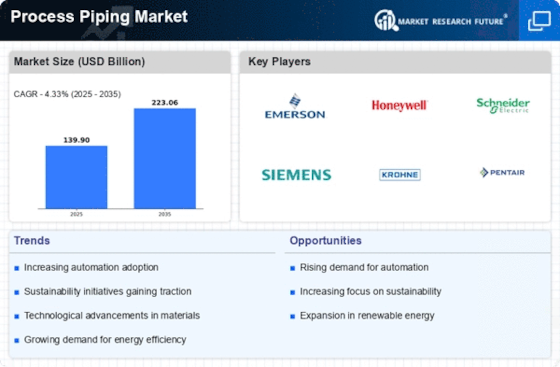

Increasing Demand for Energy

The Process Piping Market is experiencing a notable surge in demand driven by the energy sector. As countries strive to enhance energy production and distribution, the need for efficient piping systems becomes paramount. The International Energy Agency projects that global energy demand will increase by 30% by 2040, necessitating advanced piping solutions to transport oil, gas, and renewable energy sources. This trend is likely to propel investments in process piping infrastructure, as companies seek to optimize their operations and reduce costs. Furthermore, the shift towards cleaner energy sources may lead to the development of specialized piping systems designed to handle new types of fuels and energy carriers, thereby expanding the market's scope.

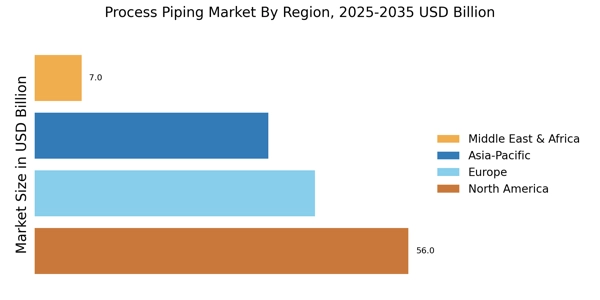

Industrial Growth and Urbanization

Rapid industrial growth and urbanization are pivotal factors influencing the Process Piping Market. As urban areas expand, the demand for infrastructure, including water supply, sewage systems, and industrial facilities, increases significantly. According to the United Nations, urban populations are expected to reach 68% by 2050, creating a pressing need for robust piping systems. Industries such as construction, manufacturing, and chemicals are expanding, further driving the demand for process piping solutions. This growth is likely to stimulate innovation in materials and technologies used in piping systems, enhancing their efficiency and durability. Consequently, the market is poised for substantial growth as industries adapt to meet the needs of burgeoning urban centers.

Regulatory Compliance and Safety Standards

The Process Piping Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies worldwide are increasingly enforcing regulations to ensure the safe transport of hazardous materials and to protect the environment. For instance, the Occupational Safety and Health Administration has established guidelines that necessitate the use of high-quality piping materials and installation practices. This regulatory landscape compels companies to invest in advanced piping solutions that meet these standards, thereby driving market growth. Additionally, the emphasis on safety and environmental protection is likely to foster innovation in the development of safer and more efficient piping systems, further enhancing the market's potential.

Technological Innovations in Piping Systems

Technological advancements are reshaping the Process Piping Market, leading to the development of innovative piping solutions. The integration of smart technologies, such as IoT and automation, is enhancing the efficiency and reliability of piping systems. These innovations allow for real-time monitoring and predictive maintenance, reducing downtime and operational costs. According to industry reports, the adoption of smart piping technologies is expected to grow at a compound annual growth rate of over 15% in the coming years. This trend indicates a shift towards more intelligent and responsive piping systems, which could significantly improve operational efficiency across various sectors, including oil and gas, chemicals, and water treatment.

Sustainability and Environmental Considerations

Sustainability is becoming a crucial driver in the Process Piping Market as companies increasingly prioritize environmentally friendly practices. The growing awareness of climate change and resource depletion is prompting industries to adopt sustainable piping solutions. This includes the use of recyclable materials and energy-efficient manufacturing processes. According to recent studies, the market for sustainable piping solutions is projected to grow by 20% annually as companies seek to reduce their carbon footprint. Furthermore, regulatory pressures to minimize environmental impact are likely to accelerate the adoption of sustainable practices in the piping industry. This shift not only enhances corporate responsibility but also opens new avenues for innovation and market expansion.