Research Methodology on Produced Water Treatment Market

Introduction

The purpose of this research methodology is to investigate the global Produced Water Treatment Market. Produced water is water that's contained in an underground formation and is moved to the surface when oil or gas is extracted from it. It is usually saline water, and it mostly includes impurities like organic and inorganic compounds and dissolved salts. In recent years, various technologies have been developed to address the challenges of produced water management. These include chemical treatments, membrane technologies, and others. Increasing energy and agricultural needs, along with the growing water scarcity, are some of the major factors driving the growth of produced water treatment market.

Research Objectives

The main objective of this research methodology is to evaluate the current and future market trends for the global produced water treatment market to develop strategies and plans for effective market growth. The particular objectives of the research are as follows:

- Analyze the market trends, drivers, and restraints of the global produced water treatment market.

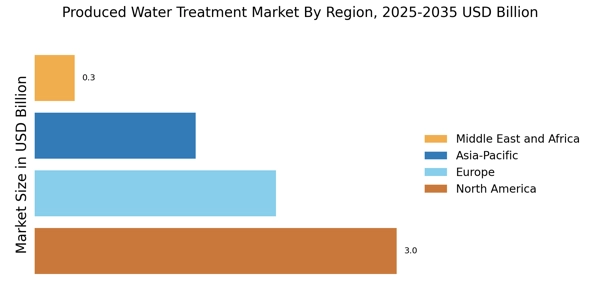

- Identify the potential opportunities and market size in the global produced water treatment market.

- Examine the key players and their strategies in the global produced water treatment market.

- Analyze the impact of technological advancements on the development of the global produced water treatment market.

- Develop market forecasts for the global produced water treatment market from 2023-2030.

Research Design

Due to the broad nature of the research involved in this project, a combination of both qualitative and quantitative methods will be used to collect and analyse data. This includes a literature review, interviews, surveys, market insights, and secondary data analysis of the existing market information. A detailed research methodology was developed to answer the research objectives effectively.

Data Collection & Analysis

Data collection and analysis are vital steps to achieve research objectives. To obtain the required data, both primary & secondary sources will be applied for the current research. For the primary data, a structured questionnaire will be employed to gain insights into the researched market. To assess the developed questionnaire, trial surveys will be conducted at the pilot stage of the data collection. Moreover, semi-structured interviews will be conducted with the experts in the field to gain valuable insights into the current market trends & challenges. On the other hand, secondary data will be gathered from newspapers, magazines, journals, and other commercial websites. Quantitative analysis techniques will be employed for the market data analysis, such as PESTEL analysis, regression analysis, and SWOT analysis.

Conclusion

This research methodology provided an understanding of the research objectives and discussed the methods that were used to collect and analyze data for the purposes of the proposed research. Primary and secondary data collection methods were outlined, along with their advantages and limitations. It is hoped that this research methodology can provide useful insights into the research project and can be used to effectively answer the research objectives.