Market Share

Protective Coatings Market Share Analysis

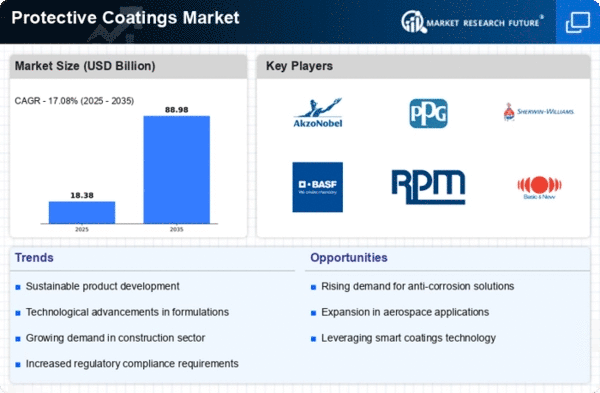

The Protective Coatings Market is among important segments of the coatings and surface protection industry. It uses a large group of market share positioning strategies for managing the competitive landscape. The prime method is specialization through application of advanced technology and innovation. Within the market for protective coatings, companies put a lot of money into research and development to develop the products with the enhanced properties, for instance, corrosion resistance, fire resistance, and chemical resistance. Through having advanced technology, these companies position themselves at the front of the line in offering high-performance coating solutions in areas like oil and gas, design, and the marine where protection against toughening extenuating circumstances is critical.

Another key strategy in the protective coatings market is the cost leadership. While some manufacturers focus on developing the production process, sourcing raw materials in an efficient manner, and achieving economies of scale they become competitive as they are able to offer coatings cost effectively. This strategy is most viable when price factor is crucial, as it is in the industries of construction and vehicle paint coatings. With the provision of cost-effective yet high-quality coatings, companies can gain a significant market share and even become preferred vendors for price-sensitive markets.

Collaboration and strategic partnerships are the linchpins for the structural market share within the protective coatings market. Companies frequently enter into relationships based on cooperation with the main stakeholders, such as manufacturers, contractors, and final users. Teamwork fosters the smoothness of the supply chain and maintains a constant and adequate distribution process. Via the strategic attitude partnership, business gets access to new markets, innovative technologies and potential customers what, in its turn, raises shares and reputation of brand.

Customer centricity is becoming a key point in the protective coatings market. Understanding and finding ways of responding to customers needs, including the particular characteristics they are looking for in the coatings, colors and application methods, is a necessary condition for increased market share. Companies invest in market research in order to discover and satisfy the needs of their customers, as their protective coatings are adapted to meet these needs. Through the provision of excellent customer service, technical support, and customer-centric delivery frameworks, relationships with clients get strengthened to attract loyalty and positive word-of-mouth, and further contribute to market share increase.

Leave a Comment