Growth of Convenience Foods

The PVDC Food Packaging Market is witnessing a surge in the demand for convenience foods, which is reshaping packaging requirements. As lifestyles become increasingly fast-paced, consumers are gravitating towards ready-to-eat and easy-to-prepare food options. PVDC packaging is particularly well-suited for these products, as it offers excellent barrier properties that preserve freshness and flavor. The convenience food sector is projected to grow at a rate of approximately 5% annually, reflecting a shift in consumer behavior. This growth presents a significant opportunity for PVDC packaging manufacturers to cater to the evolving needs of the market. By providing effective packaging solutions that enhance the convenience and quality of food products, the PVDC Food Packaging Market is likely to expand in tandem with this trend.

Regulatory Support for Food Safety

The PVDC Food Packaging Market is significantly influenced by stringent regulations aimed at ensuring food safety and quality. Governments across various regions are implementing regulations that mandate the use of safe and effective packaging materials. PVDC is often favored due to its compliance with food safety standards, which enhances its appeal among manufacturers. The increasing focus on food safety is likely to drive the adoption of PVDC packaging solutions, as they provide reliable protection against contamination. Furthermore, the regulatory landscape is evolving, with new guidelines being introduced to address emerging food safety concerns. This regulatory support is expected to bolster the PVDC Food Packaging Market, as companies seek to align their products with these standards to maintain consumer trust and market competitiveness.

Innovations in Packaging Technology

The PVDC Food Packaging Market is benefiting from ongoing innovations in packaging technology. Advances in materials science and engineering are leading to the development of new PVDC formulations that enhance performance characteristics, such as barrier properties and seal integrity. These innovations are crucial for meeting the demands of modern consumers who expect high-quality packaging that ensures food safety and freshness. Additionally, the integration of smart packaging technologies, such as QR codes and temperature indicators, is gaining traction. These technologies not only improve the user experience but also provide valuable information regarding product quality. As these innovations continue to emerge, they are likely to drive the growth of the PVDC Food Packaging Market, as manufacturers seek to differentiate their products in a competitive landscape.

Rising Demand for Extended Shelf Life

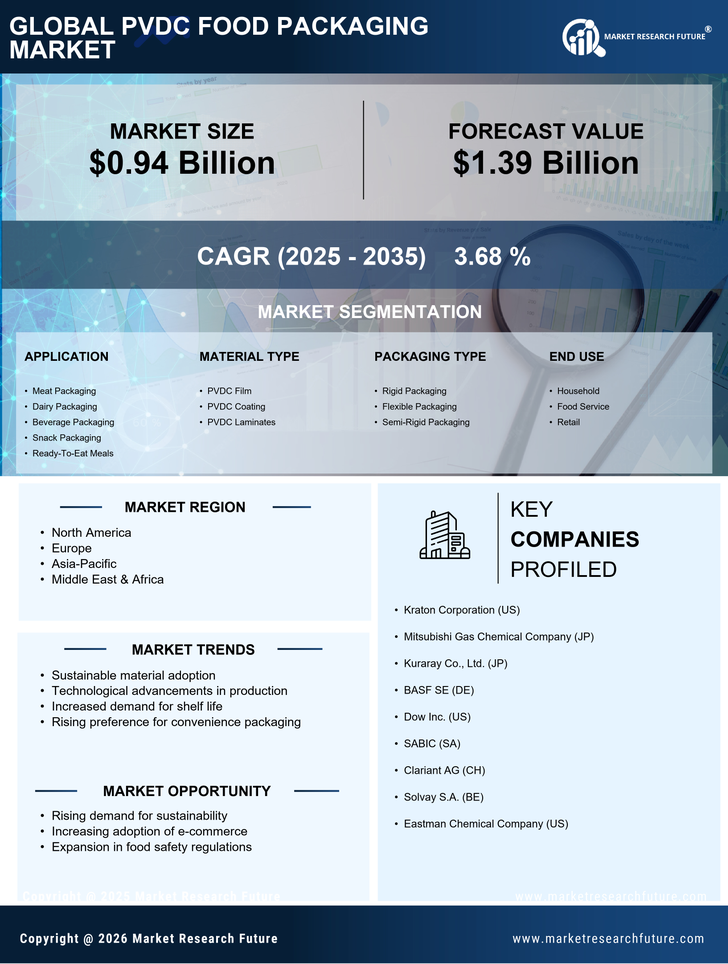

The PVDC Food Packaging Market is experiencing a notable increase in demand for packaging solutions that extend the shelf life of food products. This trend is driven by consumer preferences for fresher, longer-lasting food items. PVDC, or polyvinylidene chloride, is recognized for its excellent barrier properties against moisture, oxygen, and other environmental factors that can compromise food quality. As a result, manufacturers are increasingly adopting PVDC materials to enhance product longevity. According to recent data, the market for food packaging is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years, indicating a robust demand for effective packaging solutions. This growth is likely to be fueled by the rising awareness of food waste and the need for sustainable practices in the food industry.

Increasing Focus on Sustainable Packaging Solutions

The PVDC Food Packaging Market is increasingly aligning with the global shift towards sustainable packaging solutions. Consumers are becoming more environmentally conscious, prompting manufacturers to seek materials that minimize environmental impact. While PVDC is not biodegradable, its ability to extend shelf life can contribute to reducing food waste, which is a critical environmental concern. Moreover, manufacturers are exploring ways to enhance the recyclability of PVDC packaging. This focus on sustainability is likely to influence purchasing decisions, as consumers prefer brands that demonstrate a commitment to environmental responsibility. As a result, the PVDC Food Packaging Market may experience growth driven by the demand for sustainable practices, encouraging innovation in material development and packaging design.