E-commerce Expansion

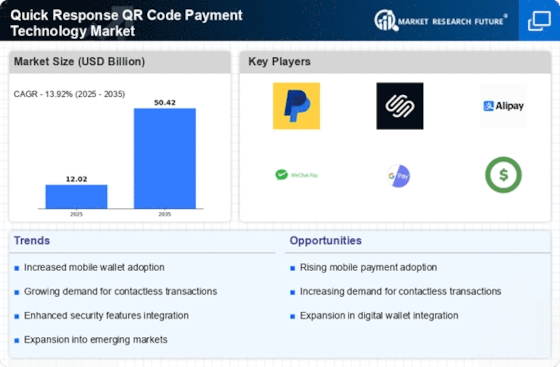

The rapid expansion of e-commerce has significantly influenced the Quick Response QR Code Payment Technology Market. With online shopping becoming increasingly prevalent, businesses are seeking efficient payment solutions to streamline transactions. QR codes offer a seamless payment experience, allowing customers to complete purchases with minimal friction. In 2025, e-commerce sales are projected to reach trillions of dollars, underscoring the necessity for innovative payment technologies. Retailers are integrating QR code payments into their platforms to cater to the growing demand for contactless transactions. This shift not only enhances customer satisfaction but also positions businesses competitively in the evolving digital marketplace, thereby driving the Quick Response QR Code Payment Technology Market.

Increasing Smartphone Penetration

The proliferation of smartphones has been a pivotal driver for the Quick Response QR Code Payment Technology Market. As of 2025, it is estimated that over 80% of the population in developed regions owns a smartphone, facilitating the adoption of QR code payment systems. This trend is particularly pronounced among younger demographics, who are more inclined to utilize mobile payment solutions. The convenience offered by QR codes, allowing users to make transactions swiftly and securely, aligns with the growing preference for digital payment methods. Furthermore, the integration of advanced features in smartphones, such as high-resolution cameras and secure payment applications, enhances the user experience, thereby propelling the growth of the Quick Response QR Code Payment Technology Market.

Integration with Emerging Technologies

The integration of Quick Response QR Code Payment Technology with emerging technologies is driving innovation within the market. Technologies such as blockchain, artificial intelligence, and the Internet of Things are being leveraged to enhance the functionality and security of QR code payments. For instance, blockchain technology can provide a secure and transparent transaction process, while AI can analyze consumer behavior to offer personalized payment experiences. As of 2025, the synergy between QR code payments and these technologies is expected to create new opportunities for businesses and consumers alike. This integration not only improves the efficiency of transactions but also positions the Quick Response QR Code Payment Technology Market at the forefront of technological advancement in the payment landscape.

Rising Demand for Contactless Payments

The increasing demand for contactless payment solutions is a significant driver for the Quick Response QR Code Payment Technology Market. Consumers are increasingly favoring payment methods that minimize physical contact, particularly in retail and service environments. QR codes provide a convenient and hygienic alternative to traditional payment methods, allowing users to complete transactions without the need for cash or card swipes. As of 2025, a substantial percentage of consumers express a preference for contactless payments, indicating a shift in consumer behavior. This trend is prompting businesses to adopt QR code payment systems to meet customer expectations and enhance the overall shopping experience, thereby propelling the growth of the Quick Response QR Code Payment Technology Market.

Government Initiatives for Digital Payments

Government initiatives aimed at promoting digital payments are playing a crucial role in the growth of the Quick Response QR Code Payment Technology Market. Various countries are implementing policies to encourage cashless transactions, thereby fostering an environment conducive to the adoption of QR code payment systems. For instance, incentives for businesses to adopt digital payment solutions and campaigns to educate consumers about the benefits of cashless transactions are becoming commonplace. As of 2025, several nations have set ambitious targets for increasing the percentage of digital transactions, which is likely to bolster the Quick Response QR Code Payment Technology Market. These initiatives not only enhance the infrastructure for digital payments but also instill consumer confidence in using QR codes for transactions.