Research Methodology on Rainscreen Cladding Market

Introduction

This research focuses on the market study of rainscreen cladding. Rain screen cladding is a walling system which is used in the external walls of many buildings to protect the buildings from extreme weather. It is a form of double-skin construction which is used for the protection of buildings from rain, wind, and harmful UV rays. Rain screen cladding offers effective building protection against climate change, thereby increasing the life of the structure. It offers optimal wind & thermal protection and also provides an effective air/moisture barrier. It is also used to improve the aesthetics of the building as it provides a great external look and flawless finishing over the external face of the building.

Ransom clamp is often used in building construction due to their cost-effectiveness, durability, weather-resistant nature, and easy installation. Companies in the rain screen cladding market are maturing and advancing in terms of designs, materials, installation processes, and other technological advancements. This has led to a large number of developments in the rain screen cladding market and more companies and manufacturers are focusing on developing more cost-effective and advanced rain screen cladding products.

Research Methodology

This research study on rain screen cladding is conducted in two stages. The first stage is a primary survey and the second is a secondary survey. The primary survey involves interviews with the manufacturers, suppliers, and users of rain screen cladding. The secondary survey involves extensive secondary research which includes data collection from several websites and government documents.

The primary survey aims to assess the current market trends, identify new and existing players in the market, as well as evaluate their strategies. Furthermore, the primary survey aims to understand the opinion of key stakeholders in the market and their views regarding the market potential and growth opportunities. The survey also aims to deduce the financial performance of the companies and the impact of the diverse market dynamics on the market.

In conducting the primary survey, semi-structured interviews were done in the form of one-on-one interviews with the participants, who were representative of the market, such as industry experts, strategic decision-makers, and developers. The primary survey is conducted in order to obtain qualitative and quantitative data and an in-depth understanding of the opinion of the market participants.

Apart from the primary survey, the research project also includes extensive secondary research. This is done to collect useful data and information regarding the key developments, strategies, and other relevant information related to the rain screen cladding market. Moreover, a comprehensive study is undertaken of the competitive landscape by conducting a thorough analysis and evaluation of the market players’ knowledge of the competitive environment.

Moreover, the factors impacting the demand and revenues of the market were assessed and a deep understanding of the competitive nature of the market was gained. Additionally, information on the pricing and cost structure of different products of rain screen cladding is gathered through secondary research.

Conclusion

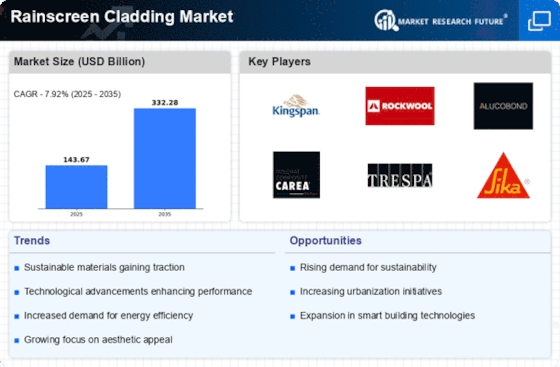

In conclusion, this research is intended to provide a detailed study of the market for rain screen cladding, including all the market dynamics, such as market trends, competition, and opportunities. The primary survey and secondary research methods discussed in this research are useful in examining the market to understand the market better and make the right decisions. Furthermore, research serves as an opportunity to identify new and existing players in the market and understand their strategies.