Integration of Advanced Technologies

The Rapid Application Development Market is significantly impacted by the integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things. These technologies are reshaping the landscape of application development, enabling faster and more efficient processes. The incorporation of AI and machine learning into rapid application development tools allows for automation of repetitive tasks, thereby accelerating development timelines. Furthermore, the Internet of Things is driving the need for applications that can manage and analyze vast amounts of data in real-time. As organizations increasingly adopt these technologies, the demand for rapid application development solutions that can leverage their capabilities is expected to grow. This trend suggests that the Rapid Application Development Market will continue to evolve, driven by the need for innovative applications that harness the power of advanced technologies.

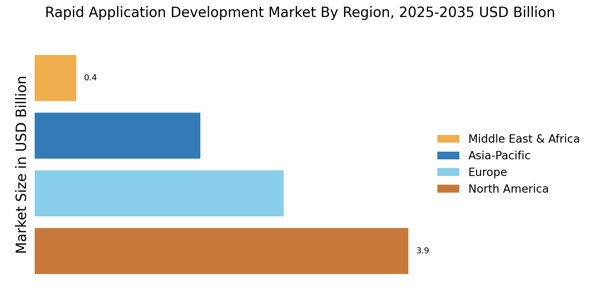

Growing Adoption of Cloud Technologies

The Rapid Application Development Market is significantly influenced by the growing adoption of cloud technologies. As organizations migrate to cloud-based infrastructures, the demand for rapid application development tools that can seamlessly integrate with these environments is increasing. Cloud platforms offer scalability, flexibility, and cost-effectiveness, which are essential for modern application development. Recent statistics suggest that cloud computing is expected to reach a market size of over 800 billion dollars by 2025, further driving the need for rapid application development solutions. This trend indicates that businesses are prioritizing cloud-native applications, which require rapid development capabilities to leverage the full potential of cloud environments. Thus, the Rapid Application Development Market is likely to expand as more companies seek to harness cloud technologies for their application development needs.

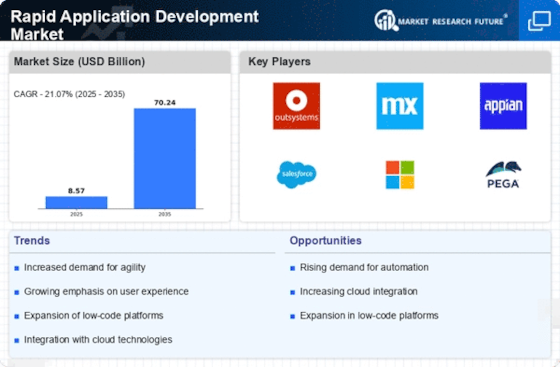

Increased Demand for Agile Development

The Rapid Application Development Market is experiencing a notable surge in demand for agile development methodologies. Organizations are increasingly recognizing the need for flexibility and speed in software development, which agile practices inherently provide. This shift is driven by the necessity to adapt to changing market conditions and customer requirements swiftly. According to recent data, agile methodologies have been adopted by over 70% of software development teams, indicating a strong preference for iterative processes. This trend is likely to continue, as businesses seek to enhance their responsiveness and reduce time-to-market for new applications. Consequently, the Rapid Application Development Market is poised for growth, as agile frameworks align well with rapid development cycles, enabling teams to deliver high-quality software solutions efficiently.

Rising Need for Custom Software Solutions

The Rapid Application Development Market is witnessing a rising need for custom software solutions tailored to specific business requirements. As organizations seek to differentiate themselves in competitive markets, off-the-shelf software often falls short of meeting unique needs. This has led to an increased demand for rapid application development tools that enable businesses to create customized applications quickly and efficiently. Recent surveys indicate that over 60% of companies prefer custom solutions to enhance their operational capabilities. This trend underscores the importance of rapid application development in enabling organizations to respond to specific challenges and opportunities. Consequently, the Rapid Application Development Market is likely to expand as more businesses recognize the value of bespoke software solutions in achieving their strategic objectives.

Emergence of Digital Transformation Initiatives

The Rapid Application Development Market is being propelled by the emergence of digital transformation initiatives across various sectors. Organizations are increasingly investing in technology to enhance operational efficiency and improve customer experiences. This transformation often necessitates the rapid development of applications that can support new digital strategies. Data indicates that nearly 90% of companies are engaged in some form of digital transformation, highlighting the urgency for tools that facilitate quick application development. As businesses strive to remain competitive in a digital-first landscape, the demand for rapid application development solutions is expected to rise. This trend suggests that the Rapid Application Development Market will continue to thrive as organizations prioritize agility and innovation in their digital transformation efforts.

Leave a Comment