Real Compound Chocolate Market Summary

As per Market Research Future analysis, the Global Real & Compound Chocolate Market Size was estimated at 41.24 USD Billion in 2024. The chocolate industry is projected to grow from 43.01 USD Billion in 2025 to 65.53 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Real & Compound Chocolate is experiencing dynamic growth driven by evolving consumer preferences and innovative product offerings.

- The market is increasingly leaning towards health-conscious choices, with consumers favoring products that align with wellness trends.

- E-commerce expansion is reshaping the chocolate purchasing landscape, particularly in North America, where online sales are surging.

- Real chocolate remains the largest segment, while compound chocolate is emerging as the fastest-growing category, reflecting diverse consumer tastes.

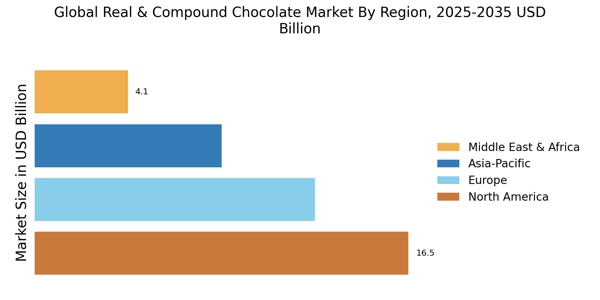

- Rising demand for premium products and an increased focus on health and wellness are key drivers propelling market growth in both North America and Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 41.24 (USD Billion) |

| 2035 Market Size | 65.53 (USD Billion) |

| CAGR (2025 - 2035) | 4.3% |

Major Players

Mars, Inc. (US), Mondelez International (US), Nestle S.A. (CH), Ferrero Group (IT), Cargill, Inc. (US), Barry Callebaut AG (CH), Hershey Company (US), Lindt & Sprüngli AG (CH), Ghirardelli Chocolate Company (US)