Expansion of the Plastics Industry

The expansion of the plastics industry serves as a significant driver for the Global Purging Compound Market Industry. With the increasing production of plastic products across various sectors, the need for effective purging solutions becomes paramount. Purging compounds facilitate the transition between different plastic resins, ensuring minimal contamination and optimal product quality. As the plastics industry continues to grow, driven by consumer demand and technological advancements, the market for purging compounds is expected to flourish. This growth trajectory is further supported by the anticipated market value of 744.4 USD Million in 2024, highlighting the critical role of purging compounds in maintaining production efficiency.

Increasing Focus on Sustainability

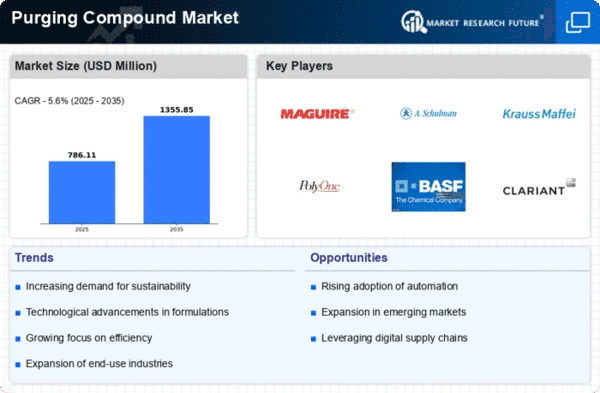

The Global Purging Compound Market Industry is significantly influenced by the increasing focus on sustainability within manufacturing practices. As companies strive to reduce their environmental footprint, the demand for eco-friendly purging compounds is on the rise. Manufacturers are seeking solutions that not only improve efficiency but also adhere to environmental regulations. For instance, the adoption of biodegradable purging compounds is gaining traction, reflecting a shift towards sustainable production methods. This trend is likely to drive market growth, with projections suggesting a market value of 1355.8 USD Million by 2035, underscoring the industry's alignment with global sustainability initiatives.

Regulatory Compliance and Quality Assurance

Regulatory compliance and quality assurance are crucial factors influencing the Global Purging Compound Market Industry. As manufacturers face stringent regulations regarding product quality and safety, the use of purging compounds becomes increasingly important. These compounds help ensure that production processes meet regulatory standards by minimizing contamination and enhancing product consistency. Industries such as food packaging and medical devices, where quality assurance is paramount, are particularly reliant on effective purging solutions. This reliance is expected to drive market growth, with projections indicating a robust CAGR of 5.6% from 2025 to 2035, reflecting the industry's commitment to maintaining high-quality standards.

Technological Advancements in Purging Solutions

Technological advancements play a pivotal role in shaping the Global Purging Compound Market Industry. Innovations in formulation and application techniques have led to the development of more effective purging compounds that cater to diverse manufacturing needs. For example, the introduction of non-toxic and environmentally friendly purging agents aligns with global sustainability goals, appealing to eco-conscious manufacturers. These advancements not only enhance the performance of purging compounds but also expand their applicability across various sectors. As a result, the market is poised for growth, with a projected CAGR of 5.6% from 2025 to 2035, indicating a robust future for purging solutions.

Rising Demand for Efficient Manufacturing Processes

The Global Purging Compound Market Industry experiences a notable surge in demand driven by the need for efficient manufacturing processes. Industries such as plastics and polymers are increasingly adopting purging compounds to minimize downtime and enhance productivity. For instance, the implementation of purging compounds can reduce material waste during color changes, thereby optimizing production efficiency. As manufacturers strive to meet stringent quality standards, the use of purging compounds becomes essential. This trend is expected to contribute to the market's growth, with projections indicating a market value of 744.4 USD Million in 2024, reflecting the industry's commitment to operational excellence.