Growing Automotive Industry Demand

The automotive sector's increasing reliance on reclaimed rubber is a significant driver for the Reclaimed Rubber Market. As automotive manufacturers strive to enhance sustainability, they are increasingly incorporating reclaimed rubber into tires and other components. The automotive industry is projected to grow at a rate of 3% annually, which could lead to a corresponding increase in the demand for reclaimed rubber. This trend is driven by the need for cost-effective and environmentally friendly materials. The integration of reclaimed rubber not only helps in reducing waste but also meets the growing consumer demand for sustainable automotive products. Consequently, the reclaimed rubber market is likely to benefit from this upward trend in automotive production and innovation.

Cost-Effectiveness of Reclaimed Rubber

The economic advantages associated with reclaimed rubber significantly influence the Reclaimed Rubber Market. Reclaimed rubber is generally less expensive than virgin rubber, which can lead to substantial cost savings for manufacturers. This cost-effectiveness is particularly appealing in industries such as automotive and construction, where rubber is a critical component. As the market for reclaimed rubber expands, it is estimated that the cost savings could reach up to 30% compared to traditional rubber sources. This financial incentive encourages more companies to adopt reclaimed rubber in their production processes, thereby fostering growth within the industry. The potential for reduced production costs while maintaining quality makes reclaimed rubber an attractive option for various applications.

Increasing Demand for Eco-Friendly Products

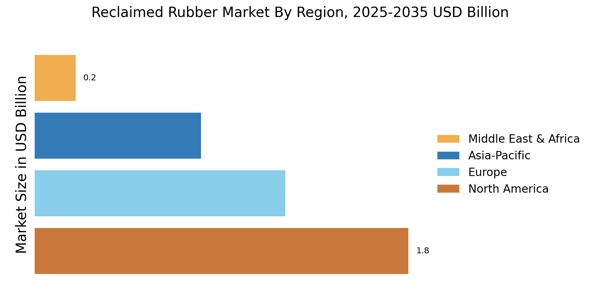

The rising consumer awareness regarding environmental sustainability appears to drive the Reclaimed Rubber Market. As industries seek to reduce their carbon footprints, reclaimed rubber, which is produced from scrap tires and other rubber products, offers a viable alternative to virgin rubber. This shift is evidenced by a projected increase in the market size, which is expected to reach approximately USD 5 billion by 2027. The demand for eco-friendly products is not merely a trend; it is becoming a necessity for manufacturers aiming to meet regulatory standards and consumer expectations. Consequently, companies are increasingly incorporating reclaimed rubber into their product lines, thereby enhancing their sustainability profiles and appealing to environmentally conscious consumers.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainable practices are likely to bolster the Reclaimed Rubber Market. Many countries are implementing stricter regulations on waste management and encouraging the use of recycled materials. This regulatory support is crucial for the growth of the reclaimed rubber sector, as it incentivizes manufacturers to adopt more sustainable practices. For instance, tax breaks and subsidies for companies utilizing reclaimed rubber can stimulate market growth. As these regulations become more prevalent, the industry could see an increase in the adoption of reclaimed rubber, potentially leading to a market expansion of 4% annually. This supportive regulatory environment is essential for fostering innovation and investment in the reclaimed rubber sector.

Technological Innovations in Recycling Processes

Advancements in recycling technologies are poised to enhance the efficiency of reclaimed rubber production, thereby impacting the Reclaimed Rubber Market positively. Innovations such as devulcanization techniques and improved grinding methods are enabling higher quality reclaimed rubber to be produced. These technological improvements not only increase the yield of usable material but also enhance the performance characteristics of reclaimed rubber, making it more competitive with virgin rubber. As a result, the market is likely to witness a surge in demand for reclaimed rubber products, particularly in high-performance applications. The integration of these technologies could potentially lead to a market growth rate of around 5% annually over the next few years.