Market Share

Recombinant Vaccines Market Share Analysis

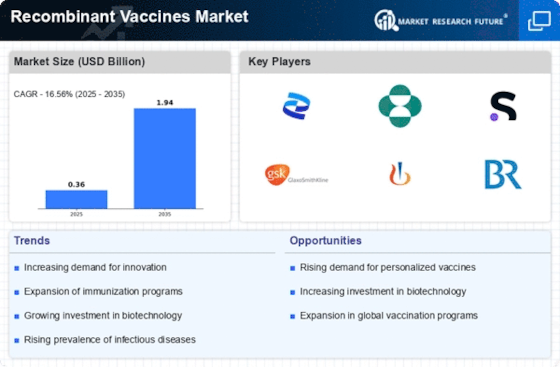

Within the broad pharmaceutical and biotechnology sector, the Recombinant Vaccines market employs various strategic methods aimed at gaining competitive edge in addition to responding to changing vaccine development landscapes. A chief tactic is through ongoing research and innovation in recombinant vaccines’ manufacturing. They spend a lot of money on research and development for vaccines made through genetic engineering that can enhance safety, have better efficacy rates, as well as offer more extensive protection against diseases targeted. Consequently, these companies bring advanced solutions into the market to distinguish themselves from competition and occupy a huge share of the prices of this kind of vaccines.

Recombinant Vaccines sector’s positioning on market share is determined by pricing strategies. Due to their significance in public health, some companies adopt different pricing models for their vaccines. Some firms may choose competitive pricing so that many people can afford their medicines while others might prefer value-based pricing where they sell at higher prices just because recombinant vaccines have distinct advantages over the other types of vaccines that are currently available in the market. This balance between how much it costs and how valuable it is guarantees spread of such innovations across most populations but also demands profits.

Success within the Recombinant Vaccines market depends heavily on collaborations and partnerships. Partnerships with research institutions, governmental bodies or global organizations assist companies during vaccine development and distribution process thereby enabling them pool resources together with knowledge that relates to complexities involved in doing so. Such collaborative works expedite both scientific investigations as well as regulatory processes besides offering opportunities for global marketing thus strengthening supply chains which makes businesses major players within Recombinant Vaccines industry.

Influencing any given segment’s market share in Recombinant Vaccines necessitates having proper marketing plus branding strategies implemented diligently by companies operating there. Companies run heavy marketing campaigns geared towards communicating product benefits to clients, creating awareness among healthcare providers and general population about its availability while establishing trust of people towards its safety along with effectiveness. The overall idea is to get involved in education, public relations and global health forums among other things that will create a strong brand presence, thus influencing market share and positioning within the competitive arena.

For firms aiming at consolidating their market share in the Recombinant Vaccines segment, geographical expansion is an important consideration. Picking locations with high prevalence rates of diseases and adapting strategies that are appropriate to local needs are imperative. When dealing with different parts of the world, businesses must tailor products so as to align them with respective cultural backgrounds or regulatory environments. In this way, it becomes possible for companies to penetrate markets successfully by tailoring their product offerings, distribution channels as well as marketing approaches depending on the distinct cultural settings and regulations existing there.

Investment in post-market surveillance, pharmacovigilance and public health interventions is also essential in order to keep up as well as expand dominance within Recombinant Vaccines industry. Constant monitoring of vaccine safety plus efficacy alongside effective patient education programs enhance trust from professionals within healthcare industry including common people who use vaccines on patients. Therefore, vendors’ continuous commitment towards safety together with general welfare is what maintains their sales levels ensuring they remain recognized stakeholders within the recombinant vaccines industry.

Leave a Comment