Regulatory Support

Government initiatives aimed at reducing sugar intake significantly influence the Global Reduced Sugar Food and Beverages Industry. Various countries have implemented regulations and guidelines to limit sugar consumption, particularly among children. For instance, taxes on sugary drinks have been introduced in several nations, encouraging manufacturers to innovate and provide healthier alternatives. This regulatory landscape not only promotes public health but also creates a favorable environment for reduced sugar products. As a result, the market is expected to expand, potentially reaching 153.4 USD Billion by 2035, driven by compliance with these regulations and the growing consumer preference for healthier options.

Health Consciousness

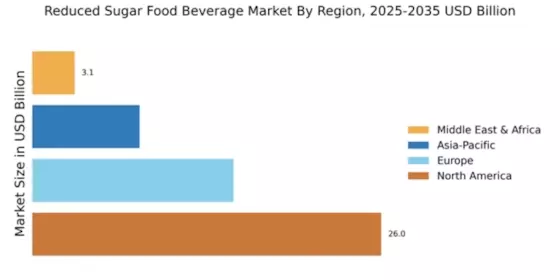

The increasing awareness of health and wellness among consumers drives the Global Reduced Sugar Food and Beverages Industry. As individuals become more informed about the adverse effects of excessive sugar consumption, they actively seek alternatives that align with healthier lifestyles. This trend is particularly evident in regions like North America and Europe, where consumers are gravitating towards products labeled as low-sugar or sugar-free. The market is projected to reach 69.5 USD Billion in 2024, reflecting a growing demand for reduced sugar options. Brands are responding by reformulating existing products and introducing new ones that cater to this health-conscious demographic.

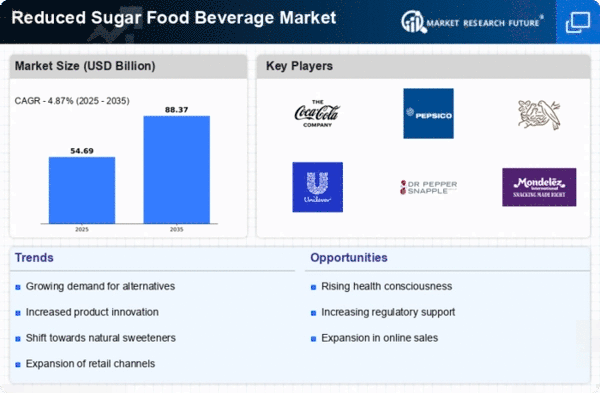

Market Growth Projections

The Global Reduced Sugar Food and Beverages Industry is projected to experience robust growth in the coming years. With a market value of 69.5 USD Billion in 2024, it is expected to reach 153.4 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 7.46% from 2025 to 2035. Such projections reflect the increasing consumer demand for healthier food and beverage options, driven by health consciousness, regulatory support, and innovative product development. The market's expansion is likely to create opportunities for manufacturers and retailers to capitalize on the growing trend towards reduced sugar consumption.

Changing Consumer Preferences

Shifts in consumer preferences towards healthier eating habits are a significant driver of the Global Reduced Sugar Food and Beverages Industry. As more individuals prioritize nutrition and wellness, there is a marked decline in the consumption of traditional sugary products. This change is particularly pronounced among younger demographics, who are more inclined to choose reduced sugar options. Brands are responding by reformulating existing products and launching new lines that emphasize lower sugar content. This evolving landscape is expected to propel the market forward, with projections indicating a substantial increase in demand for reduced sugar products in the coming years.

Innovative Product Development

Innovation plays a crucial role in shaping the Global Reduced Sugar Food and Beverages Industry. Companies are increasingly investing in research and development to create new formulations that maintain taste while reducing sugar content. This includes the use of natural sweeteners and advanced processing techniques that enhance flavor without compromising health benefits. The introduction of innovative products, such as low-sugar snacks and beverages, caters to diverse consumer preferences and dietary needs. This trend is likely to contribute to a compound annual growth rate of 7.46% from 2025 to 2035, as brands strive to meet the evolving demands of health-conscious consumers.

Increased Availability of Products

The expansion of distribution channels and increased availability of reduced sugar products significantly impact the Global Reduced Sugar Food and Beverages Industry. Retailers are increasingly stocking a variety of low-sugar options, making them more accessible to consumers. This trend is observed in both physical stores and online platforms, where consumers can easily find and purchase reduced sugar alternatives. The growing presence of these products in mainstream retail settings enhances consumer awareness and encourages trial. As a result, the market is poised for growth, with an anticipated increase in sales as more consumers opt for reduced sugar choices.