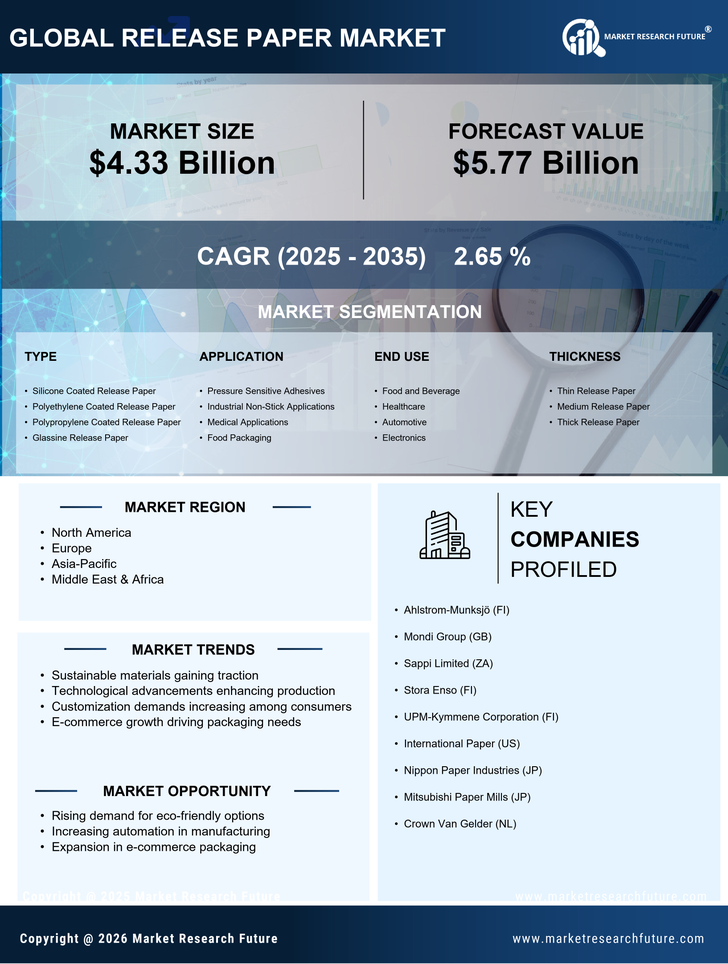

E-commerce Growth

The rapid expansion of e-commerce is significantly influencing the Release Paper Market. As online shopping continues to rise, the demand for packaging materials, including release papers, is also increasing. E-commerce businesses require efficient packaging solutions that ensure product safety during transit, which often involves the use of release papers in adhesive applications. Market data indicates that the e-commerce sector is expected to grow at a rate of approximately 10% annually, further propelling the need for reliable packaging materials. This trend suggests that companies within the Release Paper Market must adapt to the evolving needs of e-commerce, potentially leading to new product developments and innovations.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical within the Release Paper Market. Governments and regulatory bodies are implementing stringent guidelines regarding the use of chemicals and materials in packaging products. This regulatory landscape compels manufacturers to innovate and reformulate their products to meet safety and environmental standards. Compliance with these regulations not only ensures market access but also enhances brand reputation among environmentally conscious consumers. As regulations evolve, companies that proactively adapt to these changes are likely to maintain a competitive advantage. The focus on compliance is expected to drive investments in research and development, further influencing the dynamics of the Release Paper Market.

Sustainability Initiatives

The increasing emphasis on sustainability within the Release Paper Market is driving demand for eco-friendly products. Manufacturers are increasingly adopting sustainable practices, such as using biodegradable materials and reducing waste in production processes. This shift is not merely a trend but a response to consumer preferences that favor environmentally responsible products. As a result, companies that prioritize sustainability are likely to gain a competitive edge. The market for sustainable release papers is projected to grow, with estimates suggesting a compound annual growth rate of around 5% over the next few years. This growth reflects a broader movement towards sustainability across various sectors, indicating that the Release Paper Market is aligning itself with global environmental goals.

Technological Advancements

Technological advancements play a pivotal role in shaping the Release Paper Market. Innovations in coating technologies and substrate materials have enhanced the performance characteristics of release papers, making them more efficient and versatile. For instance, the development of silicone-coated release papers has improved their release properties, catering to diverse applications in industries such as adhesives and labels. Furthermore, automation in manufacturing processes has led to increased production efficiency and reduced costs. The integration of smart technologies, such as IoT, is also emerging, allowing for real-time monitoring and quality control. These advancements not only enhance product quality but also expand the potential applications of release papers, thereby driving market growth.

Rising Demand in End-User Industries

The rising demand from various end-user industries is a significant driver for the Release Paper Market. Sectors such as automotive, electronics, and healthcare are increasingly utilizing release papers for applications ranging from protective films to adhesive solutions. For instance, the automotive industry is adopting release papers for manufacturing components that require precise adhesion and surface protection. Market analysis indicates that the automotive sector alone is projected to grow at a rate of 4% annually, contributing to the overall demand for release papers. This trend underscores the importance of understanding the specific needs of different industries, as tailored solutions can enhance market penetration and foster growth within the Release Paper Market.