Market Trends

Key Emerging Trends in the Remote Patient Monitoring Market

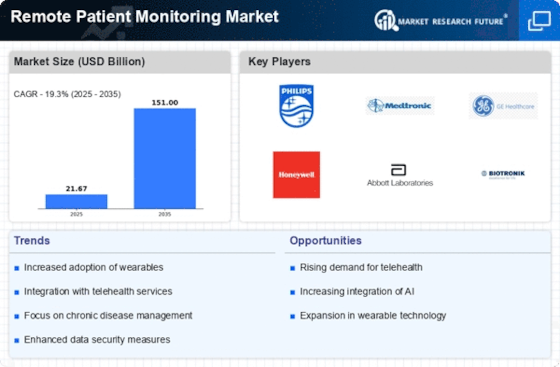

RPM (Remote Patient Monitoring) market shows strong indicators of developments powered by technology boom in healthcare sector, aging population, and centralized nature of healthcare services. To list a few, one prevalent step is the progressing trend for people to take up wearable devices and connected health technologies for remote patient monitoring. Wearables like smart watches and fitness trackers enjoy increased popularity thanks to their ability to record vital signs, physical activities, and other health metrics hard in real-time. This phenomenon therefore complements the already existing patient-centered culture, as people have the opportunity to be involved in the process of taking into account their health condition and early diagnosis.

Implementing telehealth and online care in remote patient monitoring is almost a standard now. The internet is pervasive, the number of channels has multiplied and secured information platforms have been developed, enabling the remote consultation of patients and their continuous monitoring. This trend has gained an important place especially in geriatric care where there is ongoing support for the management of chronic conditions without patients having to visit their doctors often. convenience and availability are the main features of tele-medicine which have a positive effect on patients' engagement and their adherence to a health care plan.

The application of AI and ML in distant patient monitoring systems are also worth mentioning trend. This technical tools are used to read the data sets made through remote monitoring devices to see any patterns, predict health outcomes and provide specific information. Compared to traditional algorithms the AI algorithms improve the ability of clinicians to identify potential health issues so that the providers can intervene before the health issues progress. This scheme displays the data analytics usage for more accurate/prudent and timely decisions concerning patient care.

Chronic disease management has turned out to be the premier concentrate of remote patient monitoring in the market. Significant numbers of chronic situations namely, diabetes, hypertension and cardiovascular diseases have made the demand for continuous monitoring greater and greater. Remote monitoring enables healthcare professionals to keep abreast of a patient's vital signs, medication adherence, and lifestyle factors via which any suspicious occurrences can be detected and addressed by targeted interventions. This has become the basic point that must be adopted for providing better healthcare service to the patients suffering from fatal illnesses and reducing the overall clinical loads.

The world today witnessed the world pandemic of COVID-19 advance the remote patient monitoring market toward the increasing need of remote medical care solutions to keep health services functioning in times of crisis. Remote monitoring has been of immeasurable benefit to physicians and nurses in keeping track of symptoms of COVID-19 and to managing recovery. Besides, the emergency has prompted the facilities for remote patient monitoring, hence this technology becomes more popular in healthcare system.

Leave a Comment