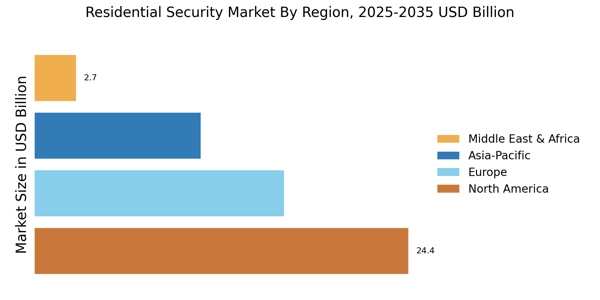

North America : Market Leader in Security Solutions

North America is the largest market for residential security, holding approximately 45% of the global share. The growth is driven by increasing crime rates, technological advancements, and a rising awareness of home safety. Regulatory support, such as the Federal Trade Commission's guidelines on consumer protection, further catalyzes market expansion. The U.S. remains the largest contributor, followed by Canada, which holds around 10% of the market share. The competitive landscape is characterized by major players like ADT Inc., Vivint Inc., and Ring, which dominate the market with innovative solutions. The presence of advanced technologies, such as smart home integration and AI-driven security systems, enhances the appeal of residential security products. As consumers increasingly prioritize safety, the demand for comprehensive security solutions continues to rise, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe is witnessing significant growth in the residential security market, accounting for approximately 30% of the global share. Factors such as increasing urbanization, rising disposable incomes, and heightened security concerns are driving demand. Regulatory frameworks, including the General Data Protection Regulation (GDPR), are shaping the market by ensuring consumer data protection and privacy, which is crucial for security service providers. Germany and the UK are the largest markets, holding around 12% and 10% of the market share, respectively. Leading countries in Europe are investing in advanced security technologies, with companies like Honeywell and SimpliSafe expanding their presence. The competitive landscape is evolving, with a mix of established players and new entrants focusing on smart home solutions. The integration of IoT devices and mobile applications is enhancing user experience, making residential security more accessible and efficient. This trend is expected to continue, driving further growth in the region.

Asia-Pacific : Rapid Growth in Security Adoption

The Asia-Pacific region is rapidly emerging as a significant player in the residential security market, holding approximately 20% of the global share. The growth is fueled by increasing urbanization, rising crime rates, and a growing middle class that prioritizes home security. Countries like China and India are leading this growth, with China alone accounting for about 12% of the market share. Government initiatives promoting smart city projects are also acting as catalysts for market expansion. The competitive landscape is diverse, with both local and international players vying for market share. Companies like Frontpoint and Protect America are expanding their operations in this region, focusing on affordable and technologically advanced solutions. The increasing adoption of smart home technologies and mobile applications is reshaping consumer preferences, leading to a surge in demand for integrated security systems. This trend is expected to continue as more households seek reliable security solutions.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa represent an untapped market for residential security, holding approximately 5% of the global share. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of security needs among consumers. Countries like South Africa and the UAE are leading the market, with the UAE accounting for about 3% of the market share. Government initiatives aimed at enhancing public safety are also contributing to market growth. The competitive landscape is characterized by a mix of local and international players, with companies focusing on affordable security solutions tailored to the region's unique needs. The presence of key players is gradually increasing, with a focus on integrating advanced technologies such as smart surveillance systems. As the region continues to develop, the demand for residential security solutions is expected to rise, presenting significant growth opportunities for market participants.