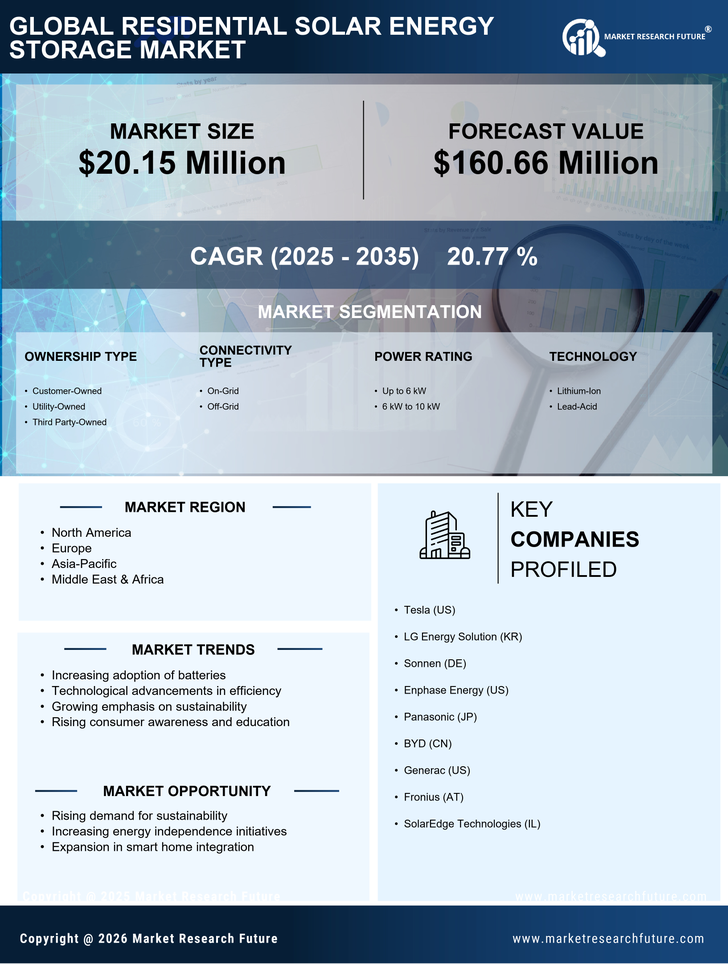

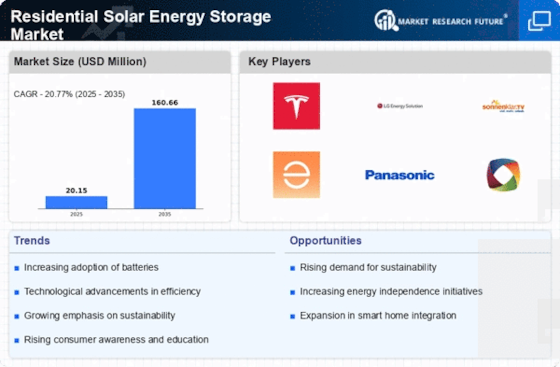

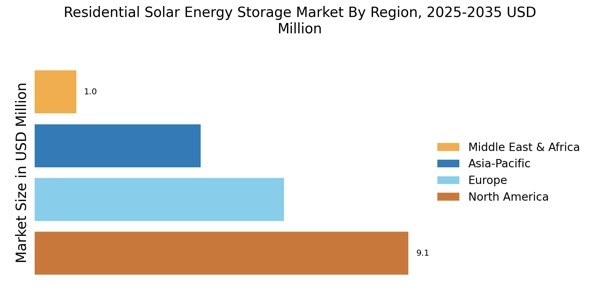

North America : Leading Innovation and Adoption

North America is the largest market for residential solar energy storage, holding approximately 45% of the global market share. The region's growth is driven by increasing energy costs, government incentives, and a strong push towards renewable energy. Regulatory frameworks, such as the Investment Tax Credit (ITC), have catalyzed demand, making solar storage more accessible to homeowners. The U.S. is the primary contributor, followed by Canada, which is rapidly expanding its solar initiatives. The competitive landscape in North America features key players like Tesla, Enphase Energy, and Generac, which are leading the charge in innovation and technology. Tesla's Powerwall and Enphase's storage solutions are particularly popular among consumers. The presence of these companies, along with supportive state policies, has fostered a robust market environment, encouraging further investment and development in solar energy storage solutions.

Europe : Sustainable Energy Transition

Europe is witnessing a significant rise in the residential solar energy storage market, accounting for about 30% of the global share. The region's growth is propelled by ambitious climate goals, such as the European Green Deal, which aims to make Europe climate-neutral by 2050. Countries like Germany and the Netherlands are leading the charge, supported by favorable regulations and incentives that encourage solar adoption and energy independence. Germany stands out as the largest market in Europe, with a strong presence of companies like Sonnen and Fronius. The competitive landscape is characterized by innovation and collaboration among manufacturers, installers, and energy providers. The increasing demand for energy storage solutions is also driven by rising electricity prices and the need for grid stability, making Europe a key player in The Residential Solar Energy Storage Market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a significant player in the residential solar energy storage market, holding approximately 20% of the global market share. The growth is driven by increasing energy demands, government initiatives promoting renewable energy, and technological advancements in battery storage. Countries like China and Japan are at the forefront, with strong government support and incentives that encourage solar energy adoption among homeowners. China is the largest market in the region, with key players like BYD and Panasonic leading the industry. The competitive landscape is marked by aggressive pricing strategies and innovation in energy storage technologies. As the region continues to urbanize and electrify, the demand for residential solar energy storage solutions is expected to rise significantly, positioning Asia-Pacific as a crucial market in the global landscape.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is gradually emerging in the residential solar energy storage market, currently holding about 5% of the global share. The growth is primarily driven by abundant solar resources, government initiatives aimed at diversifying energy sources, and increasing electricity demand. Countries like South Africa and the UAE are leading the way, implementing policies that promote renewable energy and energy storage solutions for residential use. South Africa is the largest market in the region, with a growing number of local and international players entering the market. The competitive landscape is evolving, with companies focusing on innovative solutions tailored to local needs. As the region continues to invest in renewable energy infrastructure, the residential solar energy storage market is expected to expand, providing significant opportunities for growth and development.