Rising Energy Costs

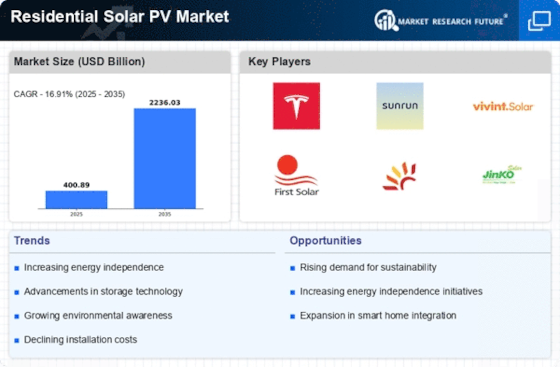

The escalating costs of traditional energy sources are a critical driver for the Residential Solar PV Market. As energy prices continue to rise, homeowners are increasingly seeking alternative solutions to mitigate their energy expenses. The average residential electricity price has seen a steady increase, prompting consumers to consider solar energy as a viable option. In many regions, the cost of solar energy has become competitive with conventional energy sources, making it an attractive choice for homeowners. This trend is expected to persist, as energy costs are projected to rise further in the coming years. Consequently, the Residential Solar PV Market is likely to experience heightened demand as more consumers turn to solar solutions to achieve energy independence and cost savings.

Technological Innovations

Technological innovations are transforming the Residential Solar PV Market, enhancing the efficiency and affordability of solar systems. Advances in photovoltaic technology, such as the development of high-efficiency solar panels and energy storage solutions, have made solar energy more accessible to homeowners. For example, the introduction of bifacial solar panels, which capture sunlight on both sides, has improved energy generation capabilities. Additionally, the integration of smart home technologies allows for better energy management and optimization. As these innovations continue to evolve, they are expected to drive down costs and improve the overall performance of solar systems. This dynamic environment suggests that the Residential Solar PV Market will continue to expand as consumers seek the latest technologies to maximize their energy savings.

Government Incentives and Policies

Government incentives and policies play a pivotal role in shaping the Residential Solar PV Market. Various countries have implemented tax credits, rebates, and grants to encourage the adoption of solar energy. For instance, in the United States, the federal solar tax credit allows homeowners to deduct a significant percentage of the cost of solar systems from their federal taxes. This financial support not only reduces the upfront costs but also enhances the return on investment for consumers. As of 2025, it is estimated that such incentives have contributed to a substantial increase in residential solar installations, with projections indicating a continued rise in adoption rates. The presence of supportive policies is likely to drive further growth in the Residential Solar PV Market.

Environmental Awareness and Climate Change

Increasing environmental awareness and concerns about climate change are significant factors influencing the Residential Solar PV Market. As more individuals recognize the impact of fossil fuels on the environment, there is a growing demand for sustainable energy solutions. Surveys indicate that a substantial percentage of homeowners are willing to invest in solar energy to reduce their carbon footprint. This shift in consumer mindset is driving the adoption of solar technologies, as individuals seek to contribute to a more sustainable future. Furthermore, governments and organizations are promoting renewable energy initiatives, further bolstering the Residential Solar PV Market. The alignment of consumer values with environmental sustainability is likely to propel the growth of solar energy adoption in residential settings.

Increased Availability of Financing Options

The increased availability of financing options is a crucial driver for the Residential Solar PV Market. Various financial institutions and solar companies now offer flexible payment plans, leases, and power purchase agreements (PPAs) that make solar energy more accessible to homeowners. These financing solutions allow consumers to install solar systems with little to no upfront costs, making it easier for them to transition to renewable energy. As of 2025, it is estimated that a significant portion of residential solar installations are financed through these innovative models. This trend is likely to continue, as more homeowners recognize the financial benefits of solar energy. The expansion of financing options is expected to further stimulate growth in the Residential Solar PV Market, enabling a broader demographic to invest in solar technologies.