Energy Independence

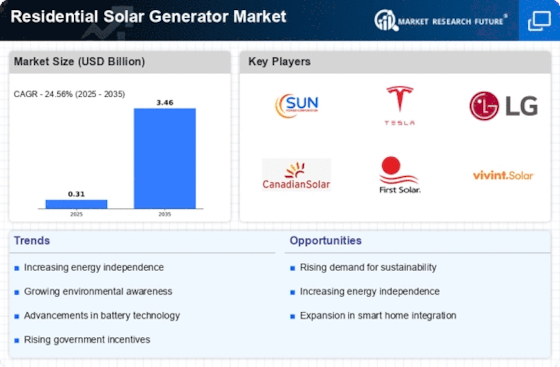

The desire for energy independence is increasingly motivating consumers to invest in the Residential Solar Generator Market. Homeowners are becoming more aware of the vulnerabilities associated with relying solely on traditional energy sources, particularly in the face of fluctuating energy prices and potential supply disruptions. By adopting solar generators, individuals can produce their own electricity, reducing their dependence on external energy providers. This shift not only enhances energy security but also provides a sense of autonomy over energy consumption. As more consumers recognize the benefits of energy independence, the demand for residential solar generators is likely to rise. This trend suggests a growing market potential, as homeowners seek to take control of their energy needs and contribute to a more sustainable energy future.

Rising Energy Costs

The escalating costs of traditional energy sources are propelling the Residential Solar Generator Market forward. As electricity prices continue to rise, homeowners are increasingly seeking alternative energy solutions to mitigate their expenses. In recent years, the average residential electricity price has shown a steady upward trend, with some regions experiencing increases of over 20%. This financial pressure encourages consumers to invest in solar generators, which can provide substantial savings over time. Furthermore, the long-term financial benefits of solar energy, including reduced utility bills and potential tax incentives, make it an attractive option for homeowners. As energy costs are projected to continue their upward trajectory, the demand for residential solar generators is likely to grow, indicating a robust market potential for this industry.

Environmental Concerns

Growing awareness of environmental issues is significantly influencing the Residential Solar Generator Market. As climate change becomes an increasingly pressing concern, consumers are more inclined to adopt sustainable energy solutions. The residential sector is responsible for a considerable portion of carbon emissions, and many homeowners are actively seeking ways to reduce their environmental footprint. Solar generators offer a clean, renewable energy source that can help mitigate these emissions. According to recent studies, households that switch to solar energy can reduce their carbon footprint by up to 80%. This shift towards eco-friendly energy solutions is not only a personal choice for many but also aligns with broader societal goals of sustainability. As environmental consciousness continues to rise, the demand for residential solar generators is expected to increase, further driving the market.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Residential Solar Generator Market. Innovations in solar panel efficiency, battery storage, and inverter technology have made solar generators more accessible and effective for homeowners. Recent developments have led to solar panels that can convert sunlight into electricity with efficiencies exceeding 22%, significantly enhancing energy production. Additionally, improvements in battery technology allow for better energy storage solutions, enabling homeowners to utilize solar energy even during non-sunny periods. The integration of smart technology into solar systems, such as monitoring apps and automated energy management, further enhances user experience and efficiency. As these technologies continue to evolve, they are likely to attract more consumers to the residential solar generator market, indicating a promising future for the industry.

Government Policies and Incentives

Supportive government policies and incentives are crucial drivers of the Residential Solar Generator Market. Many governments worldwide are implementing programs to encourage the adoption of renewable energy sources, including solar power. These initiatives often include tax credits, rebates, and grants that significantly reduce the upfront costs associated with purchasing solar generators. For instance, some regions offer tax credits that can cover up to 30% of the installation costs. Such financial incentives make solar energy more appealing to homeowners, thereby stimulating market growth. Additionally, renewable energy mandates and sustainability goals set by governments further bolster the demand for residential solar solutions. As these policies evolve and expand, they are likely to create a more favorable environment for the residential solar generator market, fostering increased adoption among consumers.

.png)