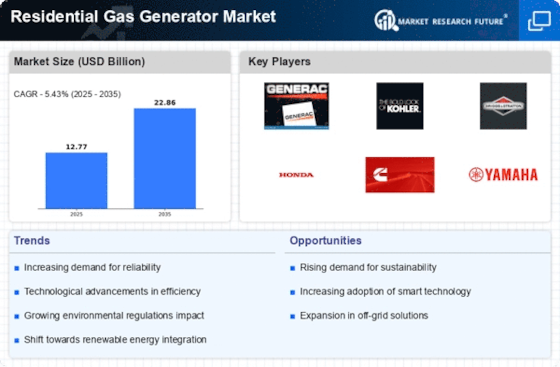

Rising Energy Costs

The Residential Gas Generator Market is experiencing a notable surge in demand due to the rising costs of energy. As electricity prices continue to escalate, homeowners are increasingly seeking alternative energy solutions to mitigate their expenses. This trend is particularly pronounced in regions where utility rates have seen significant hikes, prompting consumers to invest in residential gas generators as a cost-effective backup power source. The market data indicates that the average price of electricity has risen by approximately 15% over the past five years, leading to a heightened interest in energy independence. Consequently, the Residential Gas Generator Market is poised for growth as more households prioritize energy savings and reliability.

Increased Frequency of Power Outages

The frequency of power outages has become a pressing concern for many households, thereby driving the Residential Gas Generator Market. With extreme weather events and aging infrastructure contributing to unreliable power supply, homeowners are increasingly investing in gas generators to ensure uninterrupted power during outages. Recent statistics reveal that the average duration of power outages has increased by 20% in certain regions, underscoring the need for reliable backup solutions. This trend is likely to continue, as consumers recognize the value of having a dependable power source readily available. As a result, the Residential Gas Generator Market is expected to expand as more individuals seek to safeguard their homes against power disruptions.

Increased Home Renovations and Upgrades

The trend of increased home renovations and upgrades is positively impacting the Residential Gas Generator Market. As homeowners invest in improving their properties, the demand for reliable power sources during construction and renovation projects has risen. Many renovations require consistent power supply for tools and equipment, making gas generators an essential component for homeowners undertaking significant upgrades. Recent data shows that home improvement spending has surged by 10% year-over-year, indicating a robust market for residential gas generators. This trend suggests that the Residential Gas Generator Market will continue to thrive as more homeowners recognize the value of having a dependable power source during their renovation endeavors.

Growing Awareness of Environmental Impact

The growing awareness of environmental impact is shaping consumer preferences within the Residential Gas Generator Market. As individuals become more conscious of their carbon footprint, there is a shift towards cleaner energy solutions. Gas generators, particularly those designed to operate with lower emissions, are gaining traction among environmentally conscious consumers. This trend is supported by regulatory frameworks that encourage the adoption of cleaner technologies. Market data indicates that sales of eco-friendly gas generators have increased by 30% in the last year, reflecting a broader commitment to sustainability. Consequently, the Residential Gas Generator Market is likely to benefit from this shift as more consumers prioritize environmentally responsible energy solutions.

Technological Advancements in Generator Design

Technological advancements in generator design are significantly influencing the Residential Gas Generator Market. Innovations such as improved fuel efficiency, quieter operation, and enhanced safety features are making gas generators more appealing to consumers. The introduction of smart technology integration allows homeowners to monitor and control their generators remotely, further increasing their attractiveness. Market data suggests that the adoption of advanced generator technologies has led to a 25% increase in sales over the past two years. As these innovations continue to evolve, the Residential Gas Generator Market is likely to witness sustained growth, driven by consumer demand for modern, efficient, and user-friendly power solutions.