The Respiratory Protective Equipment Market is currently characterized by a dynamic competitive landscape, driven by increasing regulatory standards and heightened awareness of occupational safety. Key players such as 3M (US), Honeywell (US), and Dräger (DE) are strategically positioned to leverage innovation and technological advancements. 3M (US) focuses on enhancing its product portfolio through continuous research and development, while Honeywell (US) emphasizes

digital transformation and smart technologies in its offerings. Dräger (DE) is known for its commitment to high-quality manufacturing and has been expanding its global footprint, particularly in emerging markets. Collectively, these strategies contribute to a competitive environment that prioritizes safety, efficiency, and technological integration.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. This approach not only enhances responsiveness to market demands but also mitigates risks associated with global supply chain disruptions. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies like 3M (US) and Honeywell (US) is substantial, as they set industry standards and drive innovation.

In August 2025, 3M (US) announced the launch of a new line of advanced respiratory masks designed to provide enhanced filtration and comfort for industrial workers. This strategic move underscores 3M's commitment to innovation and positions the company to capture a larger share of the market by addressing the evolving needs of consumers. The introduction of these masks is likely to strengthen 3M's competitive edge, particularly in sectors where worker safety is paramount.

In September 2025, Honeywell (US) unveiled a partnership with a leading technology firm to integrate artificial intelligence into its respiratory protection systems. This collaboration aims to enhance the functionality of their products, allowing for real-time monitoring of air quality and user safety. Such advancements not only improve product performance but also align with the growing trend of digitalization in the industry, potentially setting a new benchmark for competitors.

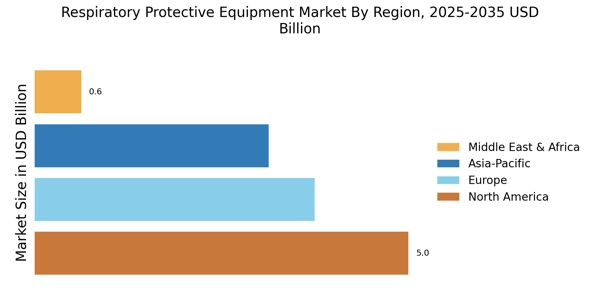

In July 2025, Dräger (DE) expanded its manufacturing capabilities in Asia, focusing on increasing production capacity for respiratory protective equipment. This strategic expansion is indicative of Dräger's intent to tap into the rapidly growing demand in the Asia-Pacific region, where regulatory frameworks are becoming increasingly stringent. By enhancing its local production capabilities, Dräger is likely to improve its market responsiveness and reduce operational costs, thereby solidifying its position in the competitive landscape.

As of October 2025, the competitive trends in the Respiratory Protective Equipment Market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing product offerings. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition may redefine market dynamics, compelling companies to invest in research and development to maintain their competitive edge.