In August 2021,Tanweer, a Nama Group subsidiary, constructed an 11 kV underground cable to the present RMU and upgraded the Dowa primary sub-station in Muscat, Oman. The project to improve grid dependability is worth OMR 186,340.

In July 2021,an RMU was installed in South Africa's Riba substation. The substation regulates power to communities such as Thushanang, Capstand, Lynnville, and Ackerville. This advancement is expected to improve circuit control and isolation, resulting in an uninterrupted and stable supply.

Alfanar Group displayed its product assortment at the Saudi Arabian Smart Grid Conference 2022 in March 2023. Some of its showcased smart grid products and solutions included new smart meters for the KSA market, RMU products, which were cleverly designed as smart ring main unit products and DAS solutions or distribution automation systems.

In January 2023, Schneider Electric brought to the Indian market a product called “Altivar Soft Starter ATS 480.” A motor is an integral part of all industrial operations. They consume approximately 60-95% of the electricity used by a plant on average.

By December 2022, Schneider Electric plans to build another factory in Bengaluru to raise its production capacity in that market. The manufacturing house will also bring six out of ten existing facilities under one roof at a cost of INR425cr.

India’s Lucy Electric announced its first order for delivery of eight recently launched Aegis Ring Main Units (12kV) in August 2022.

Schneider Electric SE partnered with Cisco to create Egypt’s national smart grid system in February 2022. Under it, Schneider Electric SE will deploy net control centers along with four thousand recognized area network (smart) ring main units or RMUs so as to sense and rectify network faults.

Mitsubishi Electric said it would construct a new production facility for Factory Automation Control Systems within India and strengthen manufacturing capabilities in the country in June 2022. Mitsubishi Electric India is investing USD27m into this plant, which is slated to open doors by December 2023.

Tanweer, under Nama Group, concluded an assignment in Muscat, Oman, in August 2021. The project entailed adding a transformer rated at 6MVA to the Dowa primary substation and installing an underground cable rated at 11 kV from the existing RING MAIN UNIT targeted towards improving grid reliability. This total project investment amounted to OMR186340 for enhancing grid reliability.

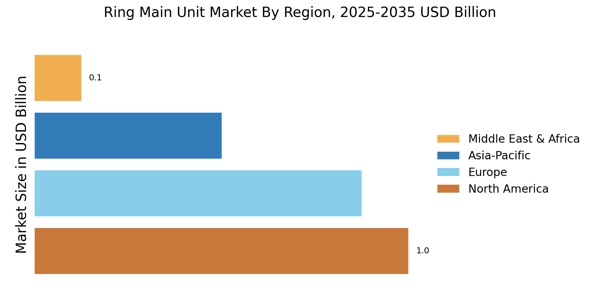

In July 2024, The Saudi Electricity Company (SEC), together with Alfanar, successfully developed the first Smart Ring Main Unit Market (RMU), which is both eco-friendly as well as unit manufactured locally within the Middle East. The unit was able to clear strict quality and safety checks from an international laboratory. This means SEC became the first utility within this region to deploy this sophisticated RMU in its grid.

This comes after the signing of various agreements during COP 28 held in Dubai, which are in line with SEC’s objectives of enhancing network performance and embracing suitable automation practices that facilitate innovation and local production.

In March 2024, Lucy Electric entered the market with EcoTec, a nitrogen dioxide and oxygen mixture that is free from Nitrogen Tetrafluoride. This eco-friendly unit is also more compliant with the new EU F-Gas regulation that came into effect in 2026. EcoTec is designed in an infrastructure-friendly format, which raises the adoption rate of the RMU’s moderate voltage networks while reducing the emission of green gases. The UK government has also set a goal to reach net zero carbon emissions by 2050, and this unit will play a crucial role in achieving such goals.

In June 2022, Mitsubishi Electric announced plans to establish a new Factory Automation Control Systems production site in India. The company also announced a pledge to expand their manufacturing capability in the country. This Indian-based plant is being funded by Mitsubishi Electric India, at the cost of USD 27 million and was set to open its operations late December 2023.

In April 2022, Siemens developed the 8DJH 24 switchgear that operates at line voltage levels up to 24 kV and contains fluorinated gas-free, an RMU that was introduced during that time. This innovation targets secondary distribution in industrial and general power grids.