Regulatory Compliance Pressures

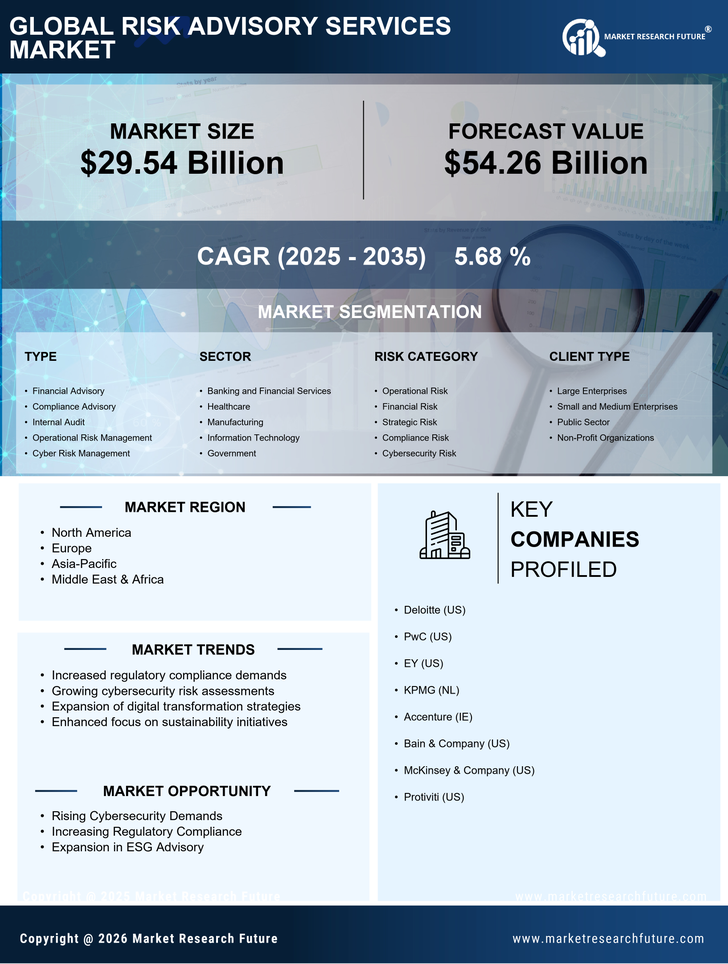

The landscape of regulatory compliance is becoming increasingly complex, compelling organizations to seek expert guidance from risk advisory services. As regulations evolve, businesses must navigate a myriad of compliance requirements across various jurisdictions. The risk advisory services market is experiencing growth as firms turn to specialists for assistance in understanding and adhering to these regulations. In 2025, the market is expected to expand as organizations recognize the potential financial and reputational repercussions of non-compliance. Risk advisory services provide essential support in developing compliance frameworks, conducting audits, and ensuring that organizations remain aligned with legal standards. This trend underscores the critical role of risk advisory services in helping businesses mitigate compliance-related risks.

Integration of Advanced Analytics

The integration of advanced analytics into risk management practices is transforming the risk advisory services market. Organizations are increasingly leveraging data analytics to gain insights into potential risks and make informed decisions. In 2025, the market is likely to see a surge in demand for advisory services that utilize predictive analytics and machine learning to enhance risk assessment processes. This shift towards data-driven decision-making enables organizations to identify emerging risks more effectively and allocate resources efficiently. As businesses strive for operational excellence, the role of risk advisory services in providing analytical capabilities becomes paramount. This trend suggests a future where data analytics is central to risk management strategies, enhancing the overall effectiveness of advisory services.

Focus on Business Continuity Planning

The emphasis on business continuity planning is becoming increasingly pronounced, driving demand for risk advisory services. Organizations are recognizing the importance of having robust plans in place to ensure operational resilience in the face of disruptions. The risk advisory services market is likely to expand as businesses seek expert guidance in developing and implementing effective continuity strategies. In 2025, the market is projected to grow as organizations prioritize risk assessments and scenario planning to prepare for potential crises. This focus on continuity planning reflects a broader understanding of the interconnectedness of risks and the need for comprehensive strategies to mitigate them. Risk advisory services play a crucial role in helping organizations navigate these complexities and enhance their preparedness for unforeseen events.

Increased Demand for Cybersecurity Solutions

The escalating frequency and sophistication of cyber threats has led to a heightened demand for risk advisory services in the cybersecurity domain. Organizations are increasingly recognizing the necessity of robust cybersecurity frameworks to protect sensitive data and maintain operational integrity. In 2025, the risk advisory services market is projected to witness a substantial growth rate, driven by the need for comprehensive risk assessments and incident response strategies. Companies are investing in risk advisory services to identify vulnerabilities and implement proactive measures, thereby enhancing their resilience against cyber attacks. This trend indicates a shift towards prioritizing cybersecurity as a critical component of overall risk management strategies, reflecting the evolving landscape of threats that organizations face today.

Emergence of Environmental, Social, and Governance (ESG) Risks

The increasing awareness of environmental, social, and governance (ESG) risks is reshaping the risk advisory services market. Organizations are under growing pressure from stakeholders to address ESG factors in their risk management frameworks. In 2025, the market is expected to see a rise in demand for advisory services that assist companies in identifying, assessing, and mitigating ESG-related risks. This trend indicates a shift towards integrating sustainability into core business strategies, as organizations recognize the potential impact of ESG risks on their reputation and financial performance. Risk advisory services are essential in guiding businesses through the complexities of ESG compliance and reporting, thereby enhancing their overall risk management capabilities. This focus on ESG factors reflects a broader societal shift towards responsible business practices.