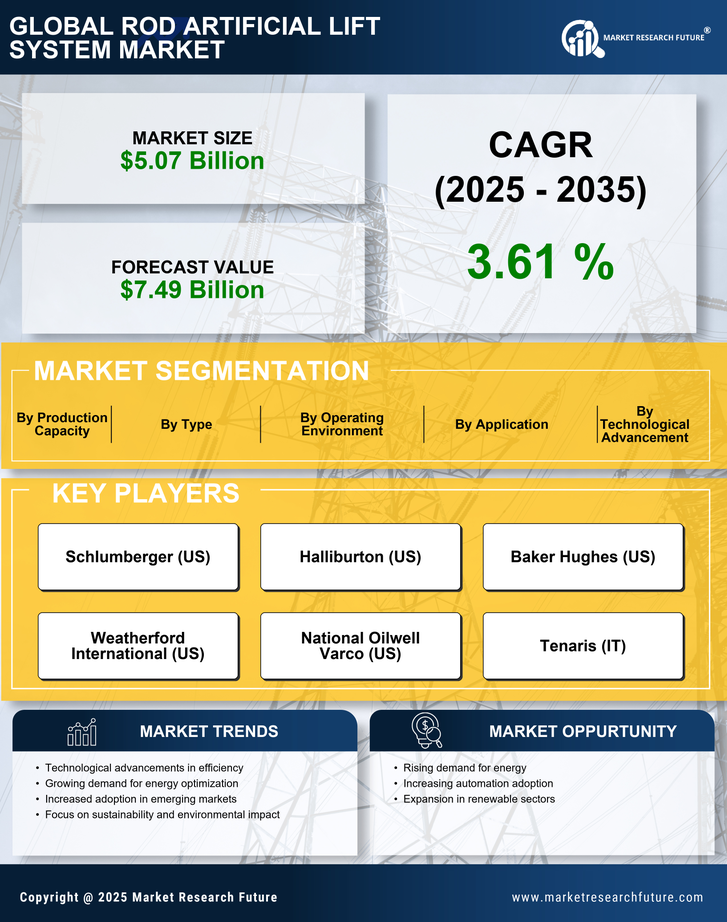

Rising Exploration Activities

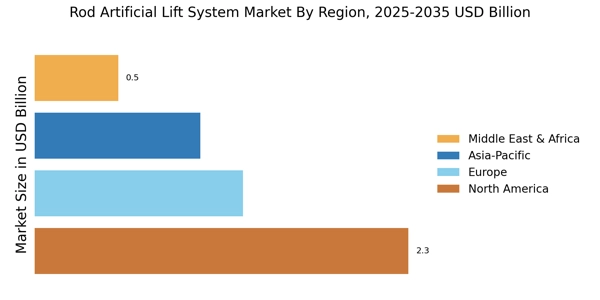

The resurgence of exploration activities in various regions is a key driver for the Rod Artificial Lift System Market. As oil and gas companies seek to tap into untapped reserves, the need for effective lifting solutions becomes paramount. According to recent data, exploration spending is expected to increase by 10% in the coming years, indicating a renewed focus on discovering new oil fields. This trend necessitates the deployment of advanced artificial lift systems to ensure optimal production from newly discovered wells, thereby driving market growth.

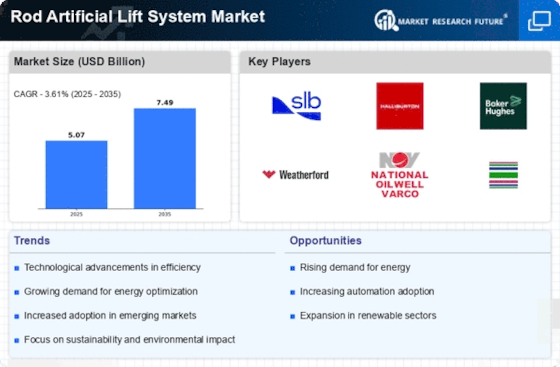

Increasing Oil Production Demand

The demand for oil continues to rise, driven by industrial growth and energy needs. This trend is particularly evident in emerging markets, where economic expansion fuels energy consumption. The Rod Artificial Lift System Market is poised to benefit from this increasing demand, as these systems are essential for enhancing oil recovery rates. In fact, the International Energy Agency projects that global oil demand could reach 104 million barrels per day by 2026. Consequently, operators are likely to invest in advanced artificial lift technologies to optimize production efficiency and meet this growing demand.

Investment in Oil and Gas Infrastructure

Investment in oil and gas infrastructure is a significant driver for the Rod Artificial Lift System Market. Governments and private entities are channeling funds into developing and upgrading infrastructure to support increased production capabilities. This investment is particularly evident in regions with aging infrastructure, where modernization is essential to enhance efficiency. According to industry reports, infrastructure spending in the oil and gas sector is projected to grow by 8% annually over the next five years. This trend is likely to create opportunities for artificial lift system providers as operators seek to integrate advanced technologies into their operations.

Focus on Enhanced Oil Recovery Techniques

Enhanced oil recovery (EOR) techniques are gaining traction as operators seek to maximize output from existing fields. The Rod Artificial Lift System Market is likely to see increased adoption of these techniques, which often require sophisticated lifting solutions. EOR methods, such as thermal recovery and gas injection, necessitate the use of reliable artificial lift systems to maintain production levels. As operators aim to extend the life of mature fields, the demand for advanced rod lift systems that can support these techniques is expected to rise, further propelling market growth.

Technological Innovations in Artificial Lift Systems

Technological advancements play a pivotal role in shaping the Rod Artificial Lift System Market. Innovations such as smart sensors, automation, and data analytics are enhancing the efficiency and reliability of artificial lift systems. These technologies enable operators to monitor performance in real-time, leading to improved decision-making and reduced operational costs. For instance, the integration of IoT devices allows for predictive maintenance, minimizing downtime. As a result, the market is witnessing a shift towards more sophisticated systems that can adapt to varying reservoir conditions, thereby increasing overall production efficiency.