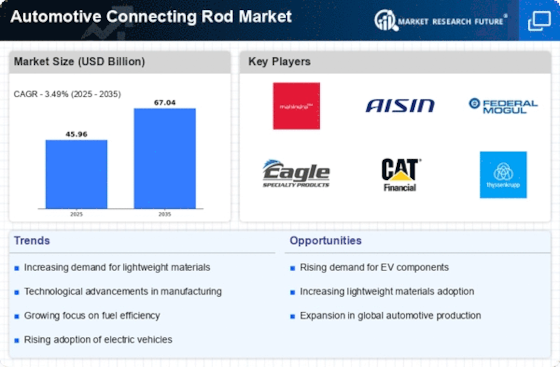

Automotive Connecting Rod Market Summary

As per Market Research Future analysis, the Automotive Connecting Rod Market Size was estimated at 45.96 USD Billion in 2024. The Automotive Connecting Rod industry is projected to grow from 47.56 USD Billion in 2025 to 67.04 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.49% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Automotive Connecting Rod Market is experiencing a transformative shift towards lightweight materials and sustainability, driven by technological advancements and increasing vehicle production.

- The market is witnessing a notable shift towards lightweight materials to enhance fuel efficiency and performance.

- Sustainability initiatives are becoming increasingly prominent, influencing material choices and manufacturing processes.

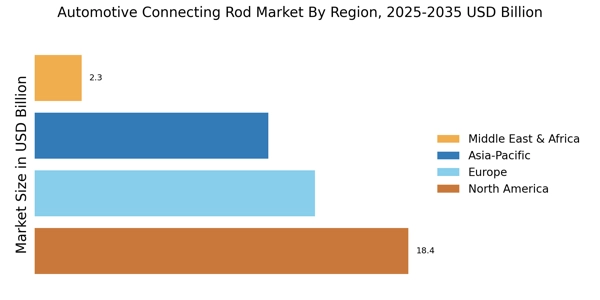

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in the automotive connecting rod sector.

- Technological advancements in engine design and rising demand for high-performance vehicles are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 45.96 (USD Billion) |

| 2035 Market Size | 67.04 (USD Billion) |

| CAGR (2025 - 2035) | 3.49% |

Major Players

Mahindra & Mahindra (IN), Aisin Seiki (JP), Federal-Mogul (US), Eagle Specialty Products (US), Caterpillar (US), Thyssenkrupp (DE), Mitsubishi Materials (JP), KSPG AG (DE), Schaeffler (DE)