Increasing Vehicle Production

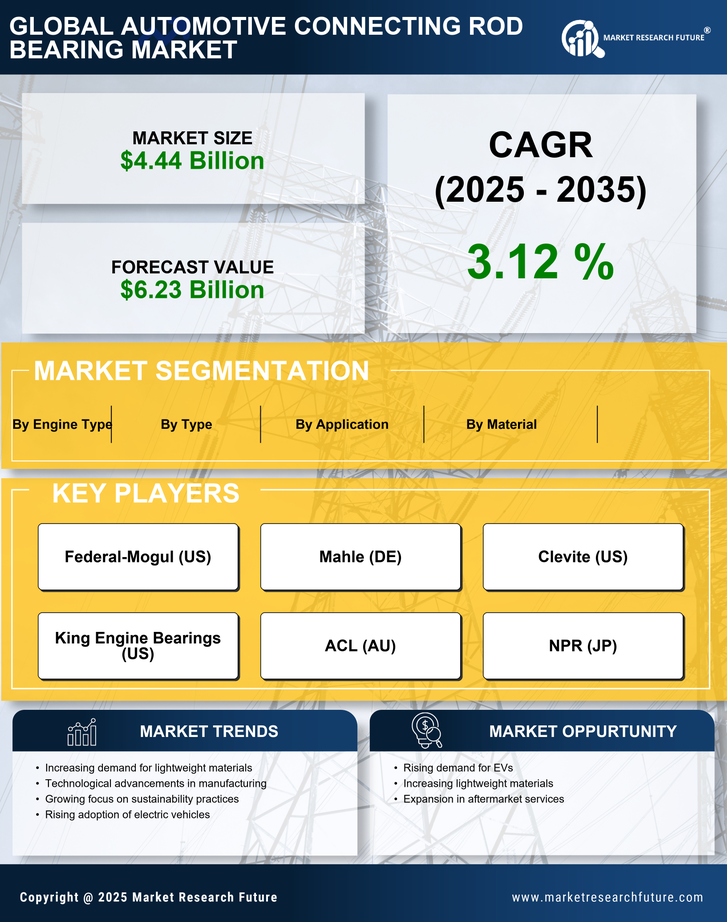

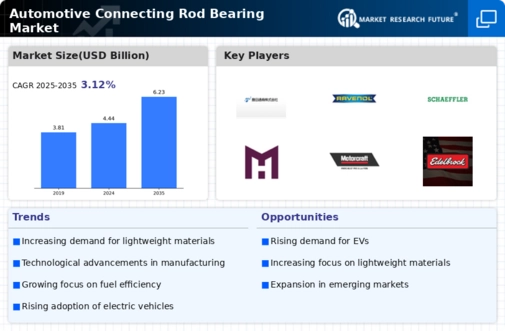

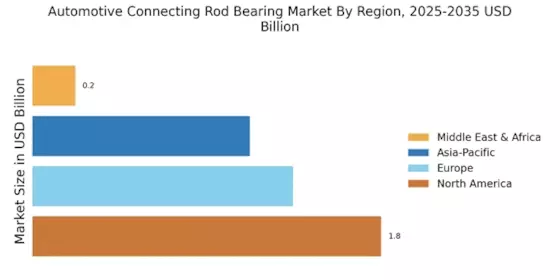

The automotive industry is witnessing a surge in vehicle production, driven by rising consumer demand and economic growth. This trend is likely to bolster the Automotive Connecting Rod Bearing Market, as each vehicle requires multiple connecting rod bearings. In recent years, production levels have shown a steady increase, with millions of vehicles manufactured annually. This growth in production not only enhances the demand for connecting rod bearings but also encourages manufacturers to innovate and improve their offerings. As automakers strive to meet consumer expectations for performance and efficiency, the need for high-quality connecting rod bearings becomes paramount. Consequently, the Automotive Connecting Rod Bearing Market is poised for expansion, reflecting the broader trends in vehicle manufacturing.

Growth of Aftermarket Services

The aftermarket services sector is experiencing notable growth, which is positively impacting the Automotive Connecting Rod Bearing Market. As vehicles age, the demand for replacement parts, including connecting rod bearings, increases. This trend is driven by the need for maintenance and repair, as well as the desire to enhance vehicle performance. The aftermarket segment is becoming increasingly important, with consumers seeking high-quality replacement parts that can extend the lifespan of their vehicles. This growth in aftermarket services is prompting manufacturers to diversify their product offerings and improve the availability of connecting rod bearings. Consequently, the Automotive Connecting Rod Bearing Market is likely to benefit from this trend, as it creates opportunities for both manufacturers and suppliers.

Regulatory Standards and Compliance

The automotive sector is increasingly subject to stringent regulatory standards aimed at enhancing vehicle safety and environmental performance. These regulations are influencing the Automotive Connecting Rod Bearing Market, as manufacturers must ensure that their products comply with these evolving standards. Compliance often necessitates the development of advanced materials and designs that meet safety and environmental criteria. As a result, manufacturers are investing in research and development to create connecting rod bearings that not only meet regulatory requirements but also improve overall vehicle performance. This focus on compliance is likely to drive innovation within the Automotive Connecting Rod Bearing Market, fostering a competitive landscape where quality and adherence to standards are paramount.

Rising Demand for Electric Vehicles

The automotive landscape is undergoing a transformation with the rising demand for electric vehicles (EVs). This shift is likely to impact the Automotive Connecting Rod Bearing Market, as EVs require different engine configurations compared to traditional internal combustion engines. While the direct demand for connecting rod bearings in EVs may decrease, the overall market dynamics are changing. Manufacturers are exploring hybrid technologies and alternative powertrains, which still necessitate the use of connecting rod bearings. Furthermore, the transition to EVs is prompting innovations in bearing technology, as manufacturers seek to optimize performance and efficiency. Thus, the Automotive Connecting Rod Bearing Market is adapting to these changes, indicating a potential for growth in specialized bearing solutions.

Technological Advancements in Engine Design

The evolution of engine design, characterized by advancements in technology, is significantly influencing the Automotive Connecting Rod Bearing Market. Modern engines are increasingly designed for higher efficiency and performance, necessitating the use of advanced connecting rod bearings that can withstand greater stresses and temperatures. Innovations such as improved materials and manufacturing processes are enabling the production of bearings that offer enhanced durability and reduced friction. As automotive manufacturers adopt these cutting-edge technologies, the demand for sophisticated connecting rod bearings is expected to rise. This shift not only enhances engine performance but also aligns with the industry's focus on sustainability and fuel efficiency, further driving growth in the Automotive Connecting Rod Bearing Market.