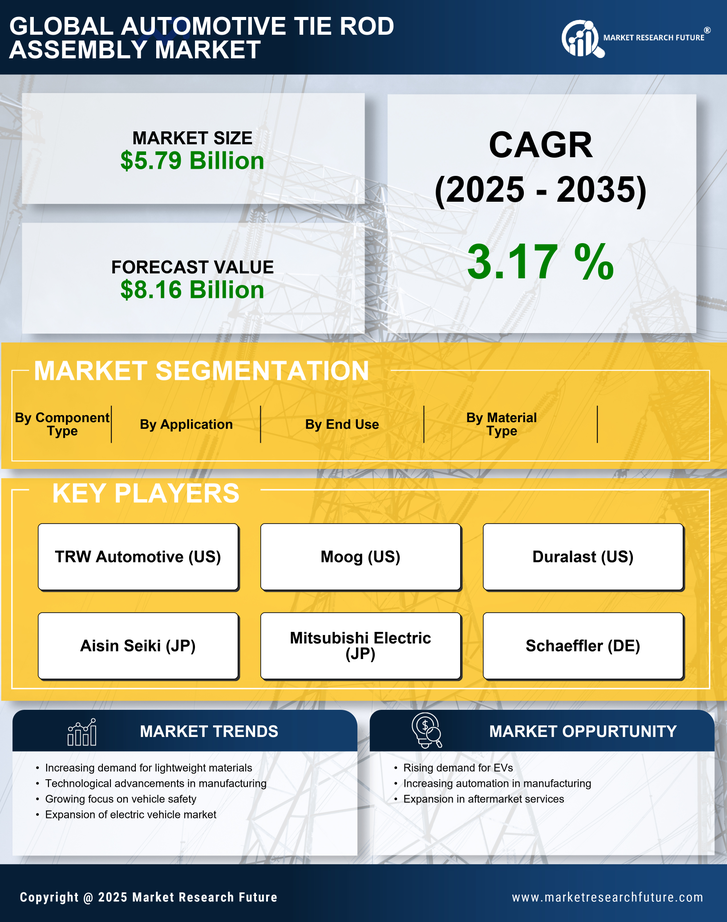

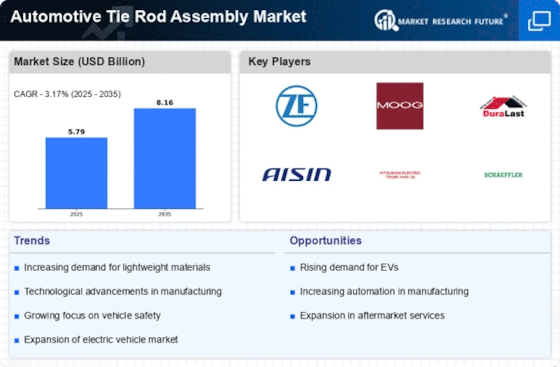

Rising Vehicle Production

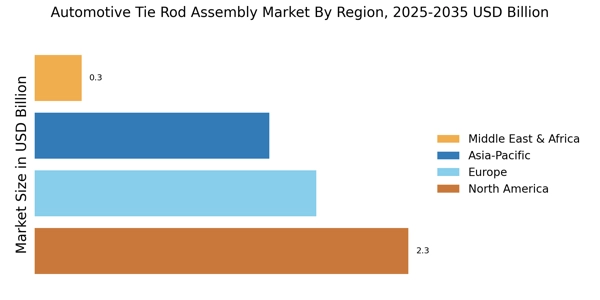

The increasing production of vehicles is a primary driver for the Automotive Tie Rod Assembly Market. As manufacturers ramp up output to meet consumer demand, the need for reliable steering components, including tie rod assemblies, escalates. In recent years, vehicle production has shown a steady upward trend, with millions of units produced annually. This surge in production directly correlates with the demand for tie rod assemblies, as they are essential for vehicle steering and handling. The Automotive Tie Rod Assembly Market is likely to benefit from this trend, as more vehicles on the road necessitate the replacement and maintenance of these critical components. Furthermore, the expansion of automotive manufacturing facilities in various regions contributes to the growth of the market, indicating a robust future for tie rod assembly suppliers.

Expansion of Aftermarket Services

The expansion of aftermarket services presents a lucrative opportunity for the Automotive Tie Rod Assembly Market. As vehicle ownership rates increase, the demand for replacement parts, including tie rod assemblies, is likely to grow. The aftermarket segment is becoming increasingly competitive, with numerous suppliers offering a wide range of products. This competition drives innovation and quality improvements, benefiting consumers and contributing to the overall growth of the Automotive Tie Rod Assembly Market. Additionally, the rise of e-commerce platforms has made it easier for consumers to access replacement parts, further fueling the demand for tie rod assemblies. As vehicle maintenance becomes a priority for owners, the aftermarket for tie rod assemblies is expected to flourish, providing a steady revenue stream for manufacturers and suppliers.

Growth of Electric Vehicle Market

The growth of the electric vehicle market is poised to have a profound impact on the Automotive Tie Rod Assembly Market. As electric vehicles (EVs) gain popularity, the demand for specialized components, including tie rod assemblies designed for EVs, is expected to rise. The unique design and weight distribution of electric vehicles necessitate the development of tie rod assemblies that can accommodate these differences. Furthermore, the increasing adoption of EVs is supported by government incentives and consumer preferences for sustainable transportation options. This shift towards electric mobility presents a significant opportunity for manufacturers in the Automotive Tie Rod Assembly Market to innovate and adapt their products to meet the specific requirements of electric vehicles. As the EV market continues to expand, the demand for compatible tie rod assemblies is likely to grow, driving overall market growth.

Increased Focus on Safety Standards

The heightened emphasis on safety standards in the automotive sector significantly influences the Automotive Tie Rod Assembly Market. Regulatory bodies across various regions have implemented stringent safety regulations that require manufacturers to ensure the reliability and durability of steering components. As a result, automotive manufacturers are compelled to invest in high-quality tie rod assemblies that meet these safety standards. This trend is evident in the growing number of safety certifications and testing protocols that tie rod assemblies must undergo. Consequently, the demand for advanced tie rod assemblies that comply with these regulations is expected to rise, driving growth in the Automotive Tie Rod Assembly Market. The focus on safety not only enhances consumer confidence but also encourages manufacturers to innovate and improve their product offerings.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the Automotive Tie Rod Assembly Market. Advanced manufacturing techniques, such as automation and precision engineering, enhance the production efficiency and quality of tie rod assemblies. These innovations allow manufacturers to produce components that are not only more durable but also lighter, contributing to overall vehicle performance. The integration of smart technologies, such as IoT and AI, into manufacturing processes is also gaining traction, enabling real-time monitoring and quality control. As these technologies become more prevalent, the Automotive Tie Rod Assembly Market is likely to experience a shift towards higher-quality products that meet the evolving demands of consumers and manufacturers alike. This trend may lead to increased investment in research and development, further driving growth in the market.